Reference no: EM131536686

Question: HX, Y and Ζ are in partnership and their agreement provides:

(a) Each partner is to receive a salary of £500 per annum.

(b) X, Y and Ζ are to share profits and losses in the proportions of one-half, three-tenths and one-fifth respectively.

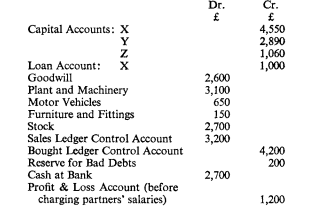

The partners agreed to dissolve the partnership on 30th June, 1959. As attempts to sell the business as a going concern had failed, the realisation of the assets was likely to be spread over some months and it was agreed that as cash was received it should be distributed. Ζ had no assets outside the partnership. The balances in the books at 30th June, 1959, before making the necessary transfers to partners; capital accounts for the year ended on that date, were as follows:

Assurance Policies for £1,000 on the life of each partner had been entered into, and the premiums had been charged to Profit & Loss Account annually. The surrender values of the policies at 30th June, 1959, were

X £400 Y £300 Ζ £300

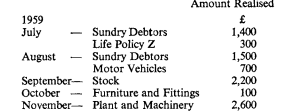

It was agreed that X and Y should each take over the policies on their own lives, and that the policy on the life of Ζ should be surrendered. Discounts of £100 were received on the payment of creditors. Cash was received on the realisation of assets as follows:

The assets other than cash realised £8,000 and the costs of realisation were £230. Write up the necessary accounts to show the final result of the dissolution and the division of the cash between the partners. Williams has no assets and cannot contribute anything towards his deficiency.