Reference no: EM131914021

To Evaluating the financial position of Teletech, we need to estimate the weighted average cost of capital for both its telecommunications segment and its products and systems segment and then compare that to the firm's corporate WACC.

The WACC assesses the amount of risk that an average capital project undertaken by the firm contains. It is also the required rate of return the firm must end up paying to later generate funds.

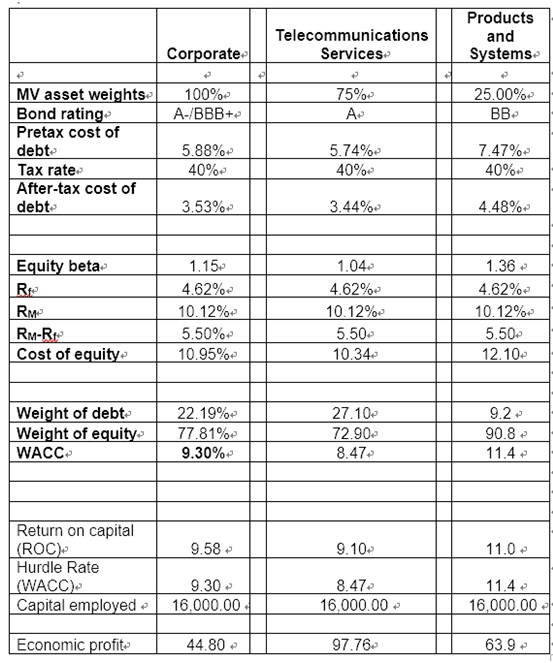

First, we took the average of similar companies in each segment to determine the cost of equity for both the telecommunications segment and the products and systems segment. We took the average beta of 1.04 as the telecommunications segment and the average beta of 1.36 for the products and systems segment. Using the CAPM approach we took the segments beta as well as the market risk premium of 5.5%.

We calculated the cost of equity for the telecommunication segment as 10.34% and the products and systems as 12.10%. Then we apply to each segment after the tax cost of debt along with the firm's percentage weights of debt and equity, 22.2% and 77.8% respectively and were and could determine that the telecommunication segment had a WACC of 8.8% while the products and systems had a WACC of 10.4%. For less risky Services segment, it requires lower hurdle rate, while products and systems segment requires higher hurdle rate.

Teletech should not agree with Helen Buono's view that "all money is green". In other words, she is saying that Teletech should out all its egg in one basket and use the same hurdle rates across the board. Using risk-adjusted hurdle rates will give the firm higher valuation.

It will also help to accept good investment and reject bad ones. We can see that it is not fair to judge all investment against one hurdle rate as different business unit carries different risk. The person that seems to have the correct understanding is Rick Phillips. He believes that Teletech should consider the risk rate for both segments and apply different hurdle rates to value the investments each business unit is going to take.

If only use single hurdle rate, the company may accept too many investments on P+S because of its high average return with higher risk. However, P+S is destroying value based on economic calculation. In conclusion, Teletech needs to apply multiple hurdle rates for different segments.