Reference no: EM131418359

Team Case

1. Find the 30-year US treasury bond rate. Assume the RAD Company's default risk is rated AA. Estimate the cost of equity for based upon the RAD raw beta for the firm of 2.3664.

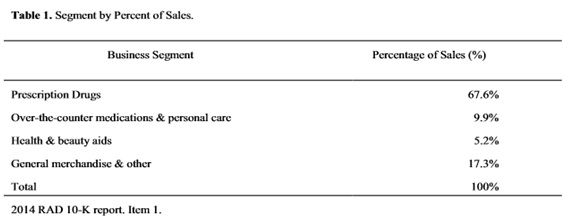

2. RAD operates in five different business segments. In 2013, the four businesses had the following results:

Based upon the industry averages reported in Table 2 below for the four segments, estimate the bottom-up unlevered beta for RAD.

3. RAD has 916.18 million shares outstanding today, trading at $6.67 per share. Assuming that the book value of debt on its books, which is $5.904 billion, is equal to market value (of debt), estimate the bottom-up levered beta for RAD. The firm has a marginal tax rate of 40%.

4. Estimate the return on equity earned by RAD in the most recent financial year, based upon average book value of equity between of the last and most recent year.

5. You have estimated the optimal debt to capital ratio for RAD, based upon minimizing the cost of capital, to be 50%. a. Estimate the current cost of capital for RAD, assuming that the beta for the stock is correctly estimated at 2.3664, the cost of debt is based upon the rating estimated from the interest coverage ratio and the long term treasury bond rate is 3.7%. RAD has 916.18 million shares outstanding today, trading at $6.67 per share and $5.904 billion in debt outstanding (book as well as market).

6. At the optimal debt to capital ratio of 50%, RAD has an interest coverage ratio of 2.198.

Estimate the cost of capital at the optimal debt ratio. (You can still use that the current regression beta of 2.1 to arrive at the new beta)

7. To look at the firm's dividend policy, you look at RAD's financial statements for the last year. RAD, in 2013, had net income of $118 million (operating income $1,132 million), capital expenditures of $315.846 million, depreciation and amortazation of $414.111 million and its non-cash working capital decreased by $112.767 million. If it financed 50% of its external financing needs with debt, estimate its FCFE in 2013.

8. Using the statement of cash flows in Table II below, estimate the percentage of the FCFE that was returned to stockholders (in the form of dividends and stock buybacks) in 2013.

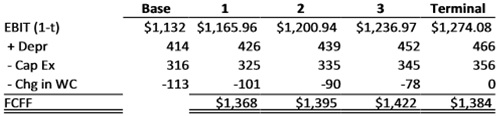

9. Here are the projected cash flows for the firm for the next 3 years, which are expected to be high growth years (with a growth rate of 10%), and for year 4, which is assumed to be the first year of stable growth (when the growth rate is expected to drop to 3%).

Using the cost of capital estimated in problem 2a, value the firm. (If you had trouble getting the cost of capital in 2a, assume a cost of capital and value the firm).

|

Job analysis and competency modeling

: The similarities and differences between job analysis and competency modeling.

|

|

Explain different types of congestion in network layer

: Explain different types of congestion in network layer?

|

|

Discuss five different healthcare statistics

: In 2-3 pages, discuss five different healthcare statistics routinely collected within a management system and how they can be used to improve healthcare at for an individual provider or on a larger level

|

|

Local events have global impact

: What is characterized by speed, continual communications, and the recognition that local events have global impact?

|

|

Estimate the return on equity earned by rad

: Estimate the return on equity earned by RAD in the most recent financial year, based upon average book value of equity between of the last and most recent year.

|

|

Probability that market will rise for 3 consecutive years

: What's the probability that the market will rise for 3 consecutive years?- the market will rise 3 years out of the next 5?

|

|

Are uber and lyft drivers employees-independent contractor

: Are Uber and Lyft Drivers employees or independent contractors? Support your conclusions with analysis from our text. Also, research recent cases concerning this question on the net. Have any courts decided this issue? Share your findings with..

|

|

How do you account for the anti-globalization reactions

: A Brief History of the Twenty-First Century, contends that "the convergence of technology and events that allowed India, China, and so many other countries to become part of the global supply chain for services and manufacturing, How do you accoun..

|

|

Are you able to pass by guessing on every question

: Are you likely to be able to pass by guessing on every question? Explain.- Suppose, after studying for a while, you believe you have raised your chances of getting each question right to 70%. How likely are you to pass now?

|