Reference no: EM13492214

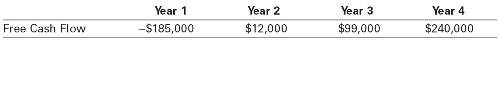

1.Bay Properties is considering starting a commercial real estate division. It has prepared the following four-year forecast of free cash flows for this division:

Assume cash flows after year 4 will grow at 3% per year, forever. If the cost of capital for this division is 14%, what is the continuation value in year 4 for cash flows after year 4? What is the value today of this division?

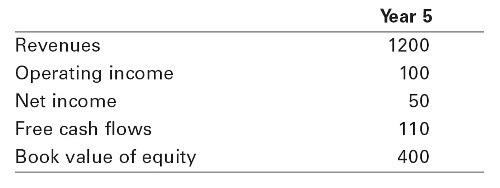

2.Your firm would like to evaluate a proposed new operating division. You have forecasted cash flows for this division for the next five years, and have estimated that the cost of capital is 12%. You would like to estimate a continuation value. You have made the following forecasts for the last year of your five-year forecasting horizon (in millions of dollars):

a. You forecast that future free cash flows after year 5 will grow at 2% per year, forever. Estimate the continuation value in year 5, using the perpetuity with growth formula.

b. You have identified several firms in the same industry as your operating division. The average P/E ratio for these firms is 30. Estimate the continuation value assuming the P/E ratio for your division in year 5 will be the same as the average P/E ratio for the comparable firms today.

c. The average market/book ratio for the comparable firms is 4.0. Estimate the continuation value using the market/book ratio.

|

What is the breakeven point in dollars

: If fixed costs decrease 10 percent, how many units must be sold to achieve the target profit?

|

|

Determine the speed of the cannon ball

: A cannon ball is fired from ground level with a speed of 60.0 m/s at an angle of 58 deg. above the horizontal. what is the speed of the cannon ball when it is directly above the wall

|

|

Explain the empirical formula of a compound containing c

: What is the empirical formula of a compound containing C, H, and O if combustion of a 1.75g sample of the compound yields 2.56g of CO2 and 1.05g of H2O

|

|

How many units must be sold to achieve the target profit

: Crow, Inc., a not-for-profit company, has a product contribution margin of $40. The fixed costs are $800,000. Crow, Inc., has set a target profit of $35,000 per year.

|

|

Estimate the continuation value in year using the perpetuity

: You forecast that future free cash flows after year 5 will grow at 2% per year, forever. Estimate the continuation value in year 5, using the perpetuity with growth formula.

|

|

Find the height from which the ball was thrown

: A ball is thrown from the window of a high-rise building with an initial velocity of 5.1 m/s at an angle of 22 deg. below the horizontal. Find the height from which the ball was thrown

|

|

What is the oscillation frequency of the spring

: At 14.7 g mass is attached to a frictionless, horizontal spring. After the spring was stretched a certain distance and released, what is the oscillation frequency of the spring

|

|

Compute the partial pressure of each of the gases

: Calculate the partial pressure of each of the gases in the mixture. He atm Ne atm Ar atm (b) Calculate the total pressure of the mixture. atm

|

|

Estimate the average power delivered to the train

: The electric motor of a model train accelerates the train from rest to 0.600m/s in 18ms. The total mass of the train is 515g. Find the average power delivered to the train

|