Reference no: EM131858870

Problem 1- Table below shows the historical returns for Companies A, B and C

|

Year

|

Company A

|

Company B

|

Company C

|

|

1

|

30%

|

26%

|

47%

|

|

2

|

7%

|

15%

|

-54%

|

|

3

|

18%

|

-14%

|

15%

|

|

4

|

-22%

|

-15%

|

7%

|

|

5

|

-14%

|

2%

|

-28%

|

|

6

|

10%

|

-18%

|

40%

|

|

7

|

26%

|

42%

|

17%

|

|

8

|

-10%

|

30%

|

-23%

|

|

9

|

-3%

|

-32%

|

-4%

|

|

10

|

38%

|

28%

|

75%

|

- Estimate the average return and standard deviation of each company.

- Estimate the correlations between Company A and B, A and C, as well as B and C.

Problem 2

Table below shows the historical returns for Companies A, B and C

|

Year

|

Company A

|

Company B

|

Company C

|

|

1

|

30%

|

26%

|

47%

|

|

2

|

7%

|

15%

|

-54%

|

|

3

|

18%

|

-14%

|

15%

|

|

4

|

-22%

|

-15%

|

7%

|

|

5

|

-14%

|

2%

|

-28%

|

|

6

|

10%

|

-18%

|

40%

|

|

7

|

26%

|

42%

|

17%

|

|

8

|

-10%

|

30%

|

-23%

|

|

9

|

-3%

|

-32%

|

-4%

|

|

10

|

38%

|

28%

|

75%

|

1. If one investor has a portfolio consisting of 50% Company A and 50% Company B, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk- free rate is 3.8%?

2. If another investor has a portfolio consisting of 1/3 Company A, 1/3 Company B and 1/3 Company C, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk-free rate is 3.8%?

Problem 3

What would happen to the portfolio risk if more and more randomly selected stocks were added?

Problem 4

You currently have $300,000. You want to invest it in the following three assets: 10-year US Treasury bond with coupon rate 3.8%, Blandy and Gourmange stocks below:

|

Year

|

Blandy

|

Gourmange

|

| |

|

|

|

Average annual return

|

6.4%

|

9.2%

|

|

Standard deviation of annual return

|

25.2%

|

38.6%

|

| |

|

|

|

Correlation between Blandy and Gourmange

|

0.11

|

|

Your goal is to have the expected return of 6.8% with a minimum portfolio risk. How much money should you allocate to these three assets?

Problem 5

Given the following information:

|

Year

|

Market

|

Blandy

|

Gourmange

|

|

1

|

30%

|

26%

|

47%

|

|

2

|

7%

|

15%

|

-54%

|

|

3

|

18%

|

-14%

|

15%

|

|

4

|

-22%

|

-15%

|

7%

|

|

5

|

-14%

|

2%

|

-28%

|

|

6

|

10%

|

-18%

|

40%

|

|

7

|

26%

|

42%

|

17%

|

|

8

|

-10%

|

30%

|

-23%

|

|

9

|

-3%

|

-32%

|

-4%

|

|

10

|

38%

|

28%

|

75%

|

- Estimate the betas for Blandy and Gourmange companies?

- If you have a portfolio of 25% Blandy and 75% Gourmange, what is the beta for your portfolio?

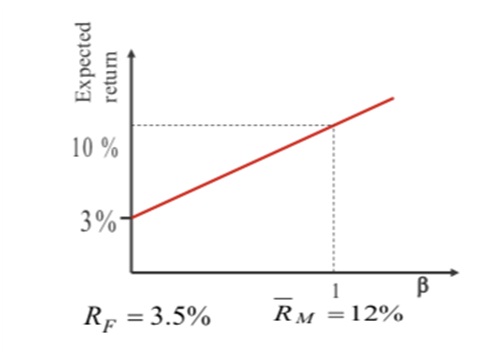

Problem 6

Based on the Capital Asset Pricing Model (CAPM) and the diagram below, what is the return of the stock if its beta is 1.2 or 0.8?