Reference no: EM13757864

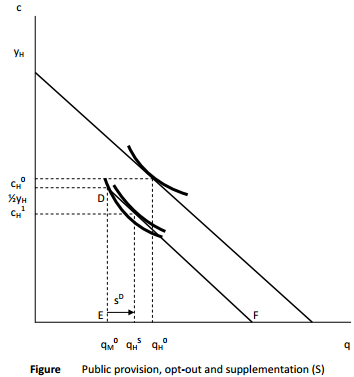

1. Consider which represents a healthcare financing scheme with no fiscal opt-out. Indicate the range/interval-plane for: (a) complementation without supplementation; (b) supplementation without any need for complementation; (c) complementation together with supplementation; (d) complementation with supplementation together amounting to a half of disposable income after the healthcare tax of T.

2. Use an 8 by 2 table to classify the 7 countries in Stabile & Thomson (2013) plus Holland: (a) as having a Bismarckian or a Beveridgean healthcare system; and (b) according to the way the system is financed.

3. On the same simple insurance diagram with complete coverage illustrate three different premia: (a) low premium thus individual will purchase insurance; (b) high with no purchase; (c) a critical premium for which individual is indifferent towards purchasing.

4. Consider Fig. and assume qp,,° is complete in the sense that the high-income individual has no need to complement yet s/he may supplement. (a) If supplementation reduces the usage of the public system, show that a lower tax T for H-type individuals may produce a win-win situation (i.e. more resources for those remaining in the system as well as a higher utility for those who opt-out). (b) Which country uses this opt-out subsidy?

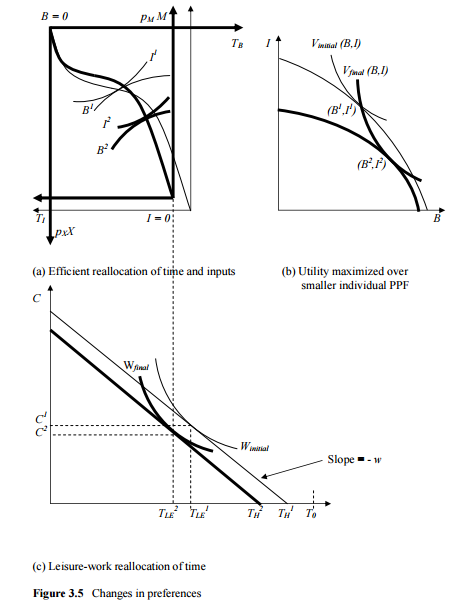

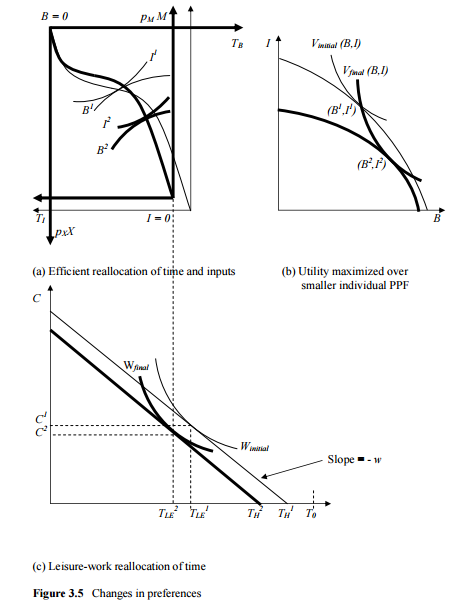

5. Using Fig. or a variant, explain and illustrate the effect of a "nudging the obese" policy needed to overcome the resistance to change due to habit formation.

6. Adult obesity is a negative input into the health production function and may interact with other inputs. (a) How does adult obesity interact with gender? (b) How does adult obesity interact with income? (c) How do anti-adult obesity policies interact with security?

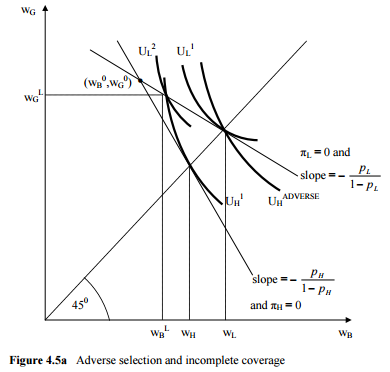

7. Using Fig. (b) explain how and why do competitive insurance markets eliminate community rates?

8. (Re-)Classification risk differs from risk classification. (a) Explain (re-)classification risk using Fig.(a). (b) How do some healthcare systems that eliminate classification risk?

9. What is a HSA (health savings account)? What incentives does it provide to insurees?

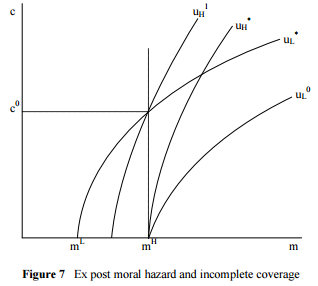

10. Using Fig. explain a function user fees can perform in healthcare systems? What other function can they perform?

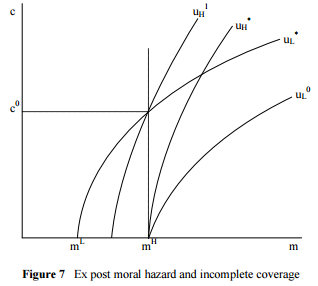

11. Graphically explain the difference between ex ante and ex post moral hazard.

5. Using Fig. or a variant, explain and illustrate the effect of a "nudging the obese" policy needed to overcome the resistance to change due to habit formation.

6. Adult obesity is a negative input into the health production function and may interact with other inputs. (a) How does adult obesity interact with gender? (b) How does adult obesity interact with income? (c) How do anti-adult obesity policies interact with security?

7. Using Fig. 4.5 explain how and why do competitive insurance markets eliminate community rates?

8. (Re-)Classification risk differs from risk classification. (a) Explain (re-)classification risk using Fig.4.5a. (b) How do some healthcare systems that eliminate classification risk?

9. What is a HSA (health savings account)? What incentives does it provide to insurees?

10. Using Fig. 4.7, explain a function user fees can perform in healthcare systems? What other function can they perform?

11. Graphically explain the difference between ex ante and ex post moral hazard.

12. Why does the interaction between the basic insurance and the supplementary insurance in Holland generate a competition lessening effect?