Reference no: EM132512451

ECON2191 Corporate Finance - Durham University

Question 1: Which of the following are the driving forces that led to Cadbury report?

An increase in "creative accounting".

Double taxation endured by shareholders.

Managers actions that focus on long term goals.

High number of high-profile business failures.

Choose the most appropriate answer:

I and IV.

I, II and III.

I, III and IV.

I, II, III and IV.

Question 2: Which of the following is NOT a type of stock market efficiency?

Allocation efficiency.

Cost efficiency.

Pricing efficiency.

Operational efficiency.

Question 3: Calculate the NPV for the worst case scenario for the following project.

|

Worst Case Scenario

|

|

Sales

|

900 000 units

|

|

Price

|

80p

|

|

Initial Investment

|

£850 000

|

|

Project Life

|

4 years

|

|

Discount rate

|

17%

|

|

Labour cost

|

22p

|

|

Material cost

|

45p

|

|

Overhead

|

11p

|

-£553 756

-£782 626

-£399 100

-£1 118 078

Question 4: If the risk premium on market portfolio is 9%, annual risk premium of small company shares compared to large company shares is 2%, the extra return received on a share with high book to market ratio compared with low book to market ratio is 3%. The risk free rate stands at 7%. The company shares are highly sensitive to market movements thus they have a high β of 1.5. Sensitivity to size SMB (the difference between the returns of portfolios with small firms and portfolios with large firms)is small and the β is -0.02. Sensitivity to HML (the difference between the returns of portfolios with value firms and portfolios with growth firms)is 0.25. What is the expected risk premium?

12.21

21.21

21.12

12.12

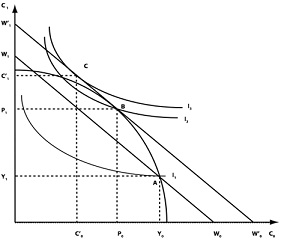

Question 5: Mr Chris is presented with the following risk and return graph. Which of the following investments will be ideal?

Rose and Ivy

Ivy and Iris

Tulip and Ivy

Iris and Lily

Hebe and Lily

Question 6: In the diagram below which of the following is TRUE?

B represents the point at which the MRTC0C1 equals -(1+r).

C represents the point at which the MRSC0C1 equals -(1+r).

In equilibrium the consumer is a lender in time period 0.

All of the above.

Question 7: The "bird in hand" argument about dividend policy suggests that:

Dividends are irrelevant.

Firms should have a 100 percent dividend policy.

Shareholders are generally risk averse and attach less risk to current dividends.

The market value of the firm is unaffected by dividend policy.

Question 8: Which of the following statements is/are true about Miller and Modigliani's proposition II?

The expected return on equity is positively related to leverage.

The required return on equity is a linear function of the firm's debt to equity ratio.

The risk to equity increases with leverage.

Choose the most appropriate answer:

I only.

II only.

I, II and III.

I and II only.

Question 9: Vertical mergers are those in which the participants are

in the same industry.

in different industries.

in different phases of the value chain.

none of the above.

Question 10: Which of the following is not a real option?

A stock option.

An abandonment option.

An investment timing option.

An expansion option.

SECTION B

Question 11. a) A firm with stakeholder focus consciously avoids actions that prove detrimental to stakeholders e.g. driving down wages. Still, maximising shareholder's wealth should be the main priority of firms. Discuss.

b) Shareholders are better protected in some countries than others. Discuss.

Question 12. Betty's financial advisor has picked two investments for her portfolio:

Sunshine company that sells summer clothes, hats and sunglasses.

Rainbow company that sells winter coats, hats and boots.

Given the following data:

|

|

Probability of event |

Returnsunshine |

ReturnRainbow |

| Warm |

0.2 |

10% |

-20% |

| Average |

0.5 |

20% |

22% |

| Wet |

0.3 |

10% |

30% |

Calculate the Expected Return and standard deviation for Sunshine and Rainbow. Comment on your results. (20 marks)

Calculate the correlation coefficient of Sunshine and Rainbow and comment upon your results. (20 marks)

Calculate the expected return and standard deviation of Sunshine and Rainbow with the following weights. (10 marks)

|

Portfolio

|

Weightssunshine (%)

|

Weightsrainbow(%)

|

|

A

|

100

|

0

|

|

B

|

90

|

10

|

|

C

|

85

|

15

|

|

D

|

80

|

20

|

|

E

|

50

|

50

|

|

F

|

25

|

75

|

|

G

|

0

|

100

|

Use the points below and plot the risk return profile. Draw the indifference curve and explain your graph. (30 marks)

|

|

Expected Return

|

Standard Deviation

|

|

Apple

|

15

|

3

|

|

Orange

|

16

|

1

|

|

Pear

|

18

|

0.5

|

|

Grape

|

20

|

1

|

|

Mango

|

26

|

10

|

|

Avocado

|

28

|

14

|

|

Peach

|

30

|

16

|

The higher the risk assumed by an asset the higher the return is demanded by investors. However, according to researchers this is not always the case. Discuss.

Question 13. a) The net income of Tango Plc is £64,000. The company has 20,000 shares outstanding and a 100 per cent dividend payout policy. The expected value of the firm one year from now is £3,091,200. The appropriate discount rate for Tango is 12 percent and the dividend tax rate is zero.

What is the current value of the firm assuming the current dividend has not yet been paid?

What is the ex-dividend price of Tango's equity if the board follows its current policy?

At the dividend declaration meeting, several board members argued that the dividend is too small and is probably depressing Tango's share price. They have proposed that Tango sells enough new shares to finance a £8.50 dividend. Show how this new dividend will impact on the share price.

b) Critically examine the merits and demerits of a stable dividend policy.

SECTION C

Critically evaluate the CAPM in the light of APT, 3 factor and 5 factor models.

Question 15. a) "If the market was efficient, the 2008 Global Financial Crisis wouldn't havehappened". Critically evaluate this statement.

b) Critically discuss the implications of the efficient market hypothesis for firms and investors.

Question 16. a) Critically discuss the reasons why a corporation will pursue Mergers and Acquisitions as a strategy.

Explain the actions a company might adopt as a defence against a takeover.

Critically examine the proposition that capital structure is irrelevant to the value of a firm.

Attachment:- corporate finance.rar