Reference no: EM13847646

Solve any 2 Questions below

Question 1

Beta plc has been trading for twelve years and during this period has achieved a good profit record. To date, the company has not been listed on a recognised stock exchange. However, Beta plc has recently appointed a new chairman and managing director who are considering whether or not the company should obtain a full Stock Exchange listing.

Required

(a) What are the advantages and disadvantages which may accrue to the company and its shareholders, of obtaining a full stock exchange listing?

(b) What factors sh*ould be taken into account when attempting to set an issue price for new equity shares in the company, assuming it is to be floated on a stock exchange?

Question 2

Mr Cowdrey runs a manufacturing business. He is considering whether to accept one of two mutually exclusive investment projects and, if so, which one to accept. Each project involves an immediate cash outlay of £100,000.

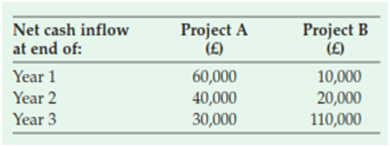

Mr Cowdrey estimates that the net cash inflows from each project will be as follows:

Mr Cowdrey does not expect capital or any other resource to be in short supply during the next three years.

Required

(a) Prepare a graph to show the functional relationship between net present value and the discount rate for the two projects (label the vertical axis ‘net present value' and the horizontal axis ‘discount rate').

(b) Use the graph to estimate the internal rate of return of each project.

(c) On the basis of the information given, advise Mr Cowdrey which project to accept if his cost of capital is (i) 6 per cent; (ii) 12 per cent.

(d) Describe briefly any additional information you think would be useful to Mr Cowdrey in choosing between the two projects.

(e) Discuss the relative merits of net present value and internal rate of return as methods of investment appraisal.

Question 3

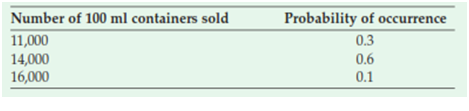

Devonia (Laboratories) Ltd has recently carried out successful clinical trials on a new type of skin cream, which has been developed to reduce the effects of ageing. Research and development costs in relation to the new product amount to £160,000. In order to gauge the market potential of the new product, an independent firm of market research consultants was hired at a cost of £15,000. The market research report submitted by the consultants indicates that the skin cream is likely to have a product life of four years and could be sold to retail chemists and large department stores at a price of £20 per 100 ml container. For each of the four years of the new product's life sales demand has been estimated as follows:

If the company decides to launch the new product, production can begin at once. The equipment necessary to make the product is already owned by the company and originally cost £150,000. At the end of the new product's life, it is estimated that the equipment could be sold for £35,000. If the company decides against launching the new product, the equipment will be sold immediately for £85,000 as it will be of no further use to the company.

The new skin cream will require two hours' labour for each 100 ml container produced. The cost of labour for the new product is £4.00 per hour. Additional workers will have to be recruited to produce the new product.

At the end of the product's life the workers are unlikely to be offered further work with thecompany and redundancy costs of £10,000 are expected. The cost of the ingredients for each 100 ml container is £6.00.

Additional overheads arising from the product are expected to be £15,000 p.a.

The new skin cream has attracted the interest of the company's competitors. If the company decides not to produce and sell the skin cream, it can sell the patent rights to a major competitor immediately for £125,000. Devonia (Laboratories) Ltd has a cost of capital of

12 per cent.

Ignore taxation.

Required

(a) Calculate the expected net present value (ENPV) of the new product.

(b) State, with reasons, whether or not Devonia (Laboratories) Ltd should launch the new product.

Question 4

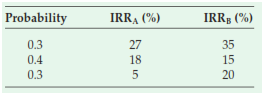

The management of Gawain plc is evaluating two projects whose returns depend on the future state of the economy as shown below:

The project (or projects) accepted would double the size of Gawain.

Required

(a) Explain how a portfolio should be constructed to produce an expected return of 20 per cent.

(b) Calculate the correlation between projects A and B, and assess the degree of risk of the portfolio in (a).

(c) Gawain's existing activities have a standard deviation of 10 per cent. How does the addition of the portfolio analysed in (a) and (b) affect risk?