Reference no: EM13979528

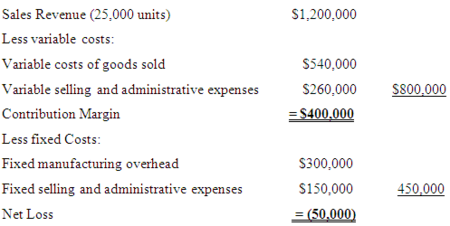

John Tyler started a small manufacturing company, JT Enterprises, at the beginning of 2005. John has prepared the following income statement for the first quarter of operations.

The variable costs of goods sold include the costs of direct materials, direct labor, and variable manufacturing overhead. The company began the quarter with no inventory; it manufactured 30,000 units over the period. Variable selling and administrative expenses are based on unites sold.

A. Calc. the unit product cost using absorption costing.

B. Rework the income statement using absorption costing.

C. does the net loss figure change using absorption costing? If yes, explain why?

D. During the second quarter of operations, JT again manufactured 30,000 units but sold 35,000 units. Prepare income statements for the second quarter using both variable-and absorption- costing methods.

E. Explain the difference in net income (or loss) in the second quarter between the two statements prepared in requirement(D)