Reference no: EM132499549

Game Theory

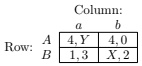

Question 1. Consider the following strategic-form game G1 where X and Y are parameters.

Figure 1: Strategic-form game G1

(a) For what values of X and Y does the Row player have a strictly dominated strategy. Provide both the values of X and Y and the strategy that is dominated.

(b) For what values of X and Y does the Column player have a weakly dominated strategy. Provide both the values of X and Y and the strategy that is dominated.

(c) For each possible outcome of the game, say whether it can be a pure-strategy Nash equilibrium of this game, and if so, the necessary conditions on X and Y .

(d) When is there a mixed-strategy Nash equilibrium of the game? Write down the mixed-strategy Nash as a function of X and Y , and the conditions on X and Y for its existence. (Note: Do not provide the mixed-strategy Nash that correspond to the pure strategies given in part c).

Question 2. Consider the standard Stackelberg model of quantity competition with two firms. Each firm i ∈ {1, 2} must choose how much quantity to produce, qi, but firm 1 makes their choice first, and firm 2 observes the choice q1 before making their choice q2. The market price is determined by an inverse demand which depends on the total quantity produced by the two firms Q = q1 + q2, where the price per unit is given by P (Q) = 61 Q. Each firm has the same marginal cost of 1 of producing every unit of the good. So the total profit is given by:

Πi(q1, q2) = P (q1 + q2) • qi - 1 • qi.

(a) Draw the extensive-form for the Stackelberg game above, making sure to label the generic nodes

q1 and (q1, q2), the players that make choices at those nodes, and the terminal node payoffs.

(b) Draw the generic proper sub-game of the Stackelberg game that is not the entire game itself.

(c) Find the sub-game reaction of firm 2, q2*(q1). Make sure to solve this for all q1 > 0.

(d) Verify that the sub-game perfect equilibrium quantity for firm 1 is given by q1* = 30.

(e) Suppose that after firm 2 chooses, another firm 3 makes a sequential choice q3. Firm 3 observes the quantity chosen by firms 1 and 2. Note that the profit function is now:

Πi(q1, q2, q3) = P (q1 + q2 + q3) • qi - 1 • qi.

i. Draw the extensive form game illustrating the generic choice nodes q1, (q1, q2) , and a generic terminal node (q1, q2, q3).

ii. Show that the best-response reaction of firm 3 at the generic sub-game node (q1, q2) is given by q3*(q1, q2) = 1/2(60 - q1 - q2) .

iii. Allowing for the sub-game response of firm 3, q3*(q1, q2) above, work out the optimal response to firm 1's choice by firm 2, q2*(q1).

iv. Taking into account both firm 2 and 3's subsequent optimal behavior, find firm 1's quantity choice qY in the sub-game perfect equilibrium.