Reference no: EM13199561

Question 1

The underlier is trading at a spot price of $100. The ten year riskless interest rate is trading at 10% p.a., continuously compounded. What is the strike price that makes the value of a European vanilla Call option on the underlier with a maturity of ten years equal to the value of a European vanilla Put option on the underlier with a maturity of ten years? Show all working.

Question 2

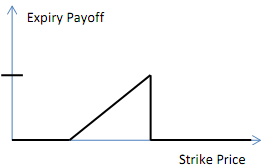

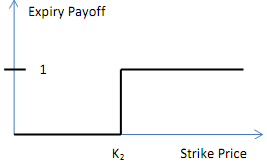

Two European vanilla Call options on the same underlier and with the same maturity are trading in the market. Option 1 has strike price K1 and is trading at $1.00, Option 2 has strike price K2 and is trading at $0.75. Option 3 is a European option on the same underlier and with the same maturity as the vanilla options. It is trading in the market at $0.15, and it has the expiry payoff shown below (a payoff of $1 is received by the buyer if the underlier is trading greater than or equal to K2 on expiry and zero otherwise):

(i) Use the three options to construct a European option with expiry payoff shown below. Complete a table like the one below to show the details of the replication portfolio. Please show all working (diagrammatic workings are acceptable provided strike prices and the y-intercept are clearly shown on your diagram(s)).

(ii) What is the no-arbitrage value of the European option on the underlier with expiry payoff shown diagrammatically in question (i) above?

Question 3

A trader buys a vertical spread by buying a Call option with a strike price of $50 and selling a Call option with a strike price of $70. The trader also sells a vertical spread by selling a Call option with a strike price of $70 and buying a Call option with a strike price of $90. All options are European, on the same underlier and have the same maturity.

(i) Draw the expiry payoff diagram for the trader's total portfolio. Make sure you annotate the diagram fully.

(ii) What are the no-arbitrage lower and no-arbitrage upper boundaries for the value of the trader's total portfolio?

|

Do you think fed chairman was a good appointment

: The economy begins in long-run equilibrium. Then one day, the president appoints a new chairman of the Federal Reserve. This new chairman is well-known for his view that inflation is not a major problem for an economy.

|

|

Evaluate a companys pricing and retail strategy

: Evaluate a companys pricing and retail strategy. Include analysis of the current market situation and the competitive strategy. Make sure to choose a company that you are familiar with and one that you have not used for other modules in the course..

|

|

Why the wage contracts have short durations

: Suppose the Federal Reserve announced that it would pursue contractionary monetary policy to reduce the inflation rate. Would the following conditions make the ensuing recession more or less severe.Wage contracts have short durations.

|

|

How to know which is pareto efficient economy

: If the output changed to 75 units of bread and 60 units of butter, the profit of the butter firm would go up by $42. The profit of the bread firm would go down by $76. 50 units of butter which the consumed by the consumer.

|

|

Draw expiry payoff diagram for the trader total portfolio

: Draw the expiry payoff diagram for the trader total portfolio. Make sure you annotate the diagram fully and what are the no-arbitrage lower and no-arbitrage upper boundaries for the value of the trader's total portfolio?

|

|

What is the total mass of the mixture in grams

: A mixture of 14g of salt and 41g of baking soda is poured into 227ml of water. What is the total mass of the mixture in grams?

|

|

What is the mean score of all of these students together

: What is the mean score of all of these students together? Round to one decimal place.

|

|

What is the rate of the wind

: A jet takes 5 hours to travel a distance of 4600 mi against the wind. The return trip takes 4 hours with the wind. What is the rate of the jet in still air and what is the rate of the wind?

|

|

Determine the totel revenue function

: find the number of items sold in a day thst will maximise the total revenue and eveluate the total revenue

|