Reference no: EM131832554

Let's see what fraction of the economic pie goes to workers in the form of wages, and let's see if it has changed over the years. The "wage share" seems like it should be easy to calculate, but there's a problem.

That problem brings us back to the big idea of opportunity cost. The problem itself is straightforward: When a small business owner makes money, should we count that as "wages" or as "profit?"

Usually, a small business owner is working at the business most days, doing the kinds of tasks that you could easily pay someone else to do: In other words, from the looking-in-the-window perspective, a business owner looks like a worker, and workers earn wages. But since the owner gets to keep all the profits that are left over after paying off the other workers and the bank, it looks like the money that he or she earns should count as profit. What to do?

The best solution is to calculate the "opportunity cost" of the business owner's time: In other words, estimate roughly how much the business owner would get paid if he or she were working as an employee. It tells us how much of the business owner's income is truly wage income.

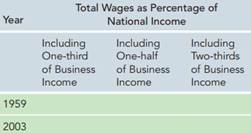

The second best solution, which we'll use in this question, is to just guess that one-third, one-half, or two-thirds of the business owner's income is really wages, and the rest is profit. As so often in economics, we make some assumptions; Let's see if that changes our view of the economy. Using this measure, let's see what has happened to the slice of the pie going to workers:

Using these data, complete the following table:

So, now that you've calculated this, does it appear that "wage share" has risen by more than 5%, fallen by more than 5%, or stayed roughly the same over the decades? Does the one third, one-half, or two-thirds business owner adjustment affect this conclusion?