Reference no: EM13317099

This Case Study shows how the absence of serious bafflers to entry is likely -to -influence the price of flat-top TV screens in the long-run time period, even when the industry has elements of market power in the sense that large-scale producers are dominant.

New entry and profit rates

During 2004 there was a significant increase in the demand for flat-panel TVs which Scott McGregor, the boss of Philips semiconductors, said was irrational since conventional TV could produce just as good an image. However, the real reason for such an increase in demand for flat-panel TVs was that manufacturers saw the possibility of a lucrative new market. LCD screens for desktop and laptop computers have become relatively common and so profit margins have fallen. However, in the N market, although the larger LCD screens cost more to make, they also command much higher profit margins.

The interesting thing about this new TV market is that both new firms and also old established firms such as Motorola and Westinghouse (who stopped making TVs decades ago) are entering the market because of the higher margins. So too are computer makers such as Dell and Gateway who already sell LCD computer monitors and can undercut traditional consumer electronics firms by selling direct over the Internet. For example, in January 2004 a 30-inch flat-panel TV from Sony cost $3,999 whereas the equivalent Dell flat-panel TV cost $2,999 over the Internet.

The market for flat-panel TVs accounted for 3 % of all TV sets sold in 2004 but is set to rise to 55% by 2005. Therefore, the market is experiencing the 'early adopter' phase of product sales which comprises the early part of the flat-panel's 'life-cycle'. The market research company, iSuppli, believes that as more suppliers enter the market and new factories are built, the prices of flat-panel Ns will probably fall by around 40% in 2004, resulting in decreased profit margins all round.

QUESTIONS:

1 What does the above account tell us about the nature of the 'barriers to entry' in the flat-panel N market?

2 How does the flat-panel N market help us understand the concepts of 'normal profit' and 'super-normal profit' in an industry?

3 What would you expect potential buyers of flat-panel TVs to do, given the information in the above account?

4. a. What is Nash equilibrium? How is it different from dominant strategy equilibrium?

b. What is meant by "first-mover advantage"? Give an example of a gaming situation with a first-mover advantage.

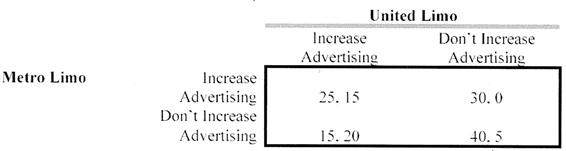

5. Two firms at the St. Louis airport have franchises to carry passengers to and from hotels in downtown St. Louis. These two firms, Metro

Limo and Urban Limo, operate nine passenger vans. These duopolists cannot compete with price, but they can compete through advertising.

Their payoff matrix is below:

a. Does each firm have a dominant strategy? If so, explain and what that strategy is.

b. What is the Nash equilibrium? Explain where the Nash equilibrium occurs in the payoff matrix.

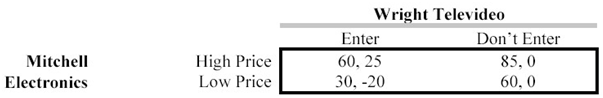

6.* Mitchell Electronics produces a home video game that has become very popular with Children. Mitchell's managers have reason to believe that Wright Televideo Company is Considering entering the market with a competing product. Mitchell must decide Whether to set a high price to accommodate entry or a low, entry-deterring price. The Payoff matrix below shows the profit outcome for each company under the alternative Price and entry strategies. Mitchell's profit is entered before the comma, and Wright's is After the comma.

a. Does Mitchell have a dominant strategy? Explain.

b. Does Wright have a dominant strategy? Explain.

c. Mitchell's managers have vaguely suggested a willingness to lower price in order to deter entry. Is this threat credible in light of the payoff matrix above?

d. If the threat is not credible, what changes in the payoff matrix would benecessary to make the threat credible? What business strategies could Mitchell use to alter the payoff matrix so that the threat is credible?