Reference no: EM13339446

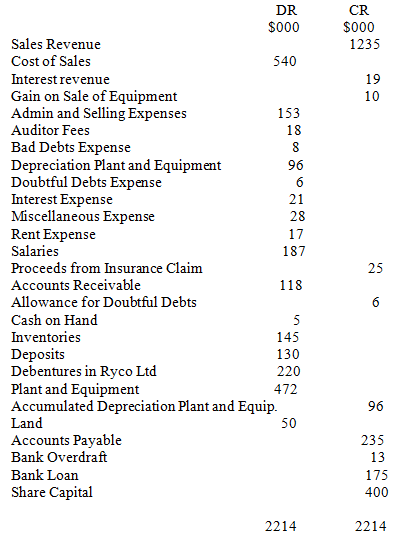

The trial balance for Commotion Ltd as at 30 June 2012 (before calculation of income tax) is as follows:

Note: this is the first year of operation of Commotion Ltd.

Additional information:

a) Included in auditor remuneration is $6,000 in fees for various management consulting services.

b) The gain on sale of plant and equipment amounted to $10,000. The carrying amount of the item sold was $77,000

c) Directors have declared a final dividend of 5 cents per share) at 30 June 2012

d) On 30 June 2012 the company revised the useful life of one of its plant and equipment assets from 5 years to 3 years. The asset had been purchased on 1 July 2011 at a cost of $75,000

e) All assets other than accounts receivable, cash on hand and inventories are non-current. All liabilities other than accounts payable, bank overdraft, current tax liability and provision for dividend are non-current.

f) Share capital comprises 400,000 fully paid ordinary shares issued on 1 July 2011.

g) Income tax rate is 30% The only temporary differences relate to doubtful debts expense and depreciation of Plant and Equipment (the depreciation allowable for tax purposes for the year ended 30 June 2012 was $80,000

h) Land was purchased on 1 July 2011 for $50,000. At 30 June 2012 the directors wish to revalue the land to $100,000.

i) On 1 August 2012 the company discovers that inventory valued at $30,000 at 30 June 2012 has no value due to flood damage.

j) At 30 June 2012 the company has signed a contract for the construction of a warehouse to the value of $250,000. All amounts under the contract are due before 30 June 2013.

k) At 30 June 2012 Commotion Ltd purchased all the assets and liabilities of a competitor Exco Ltd. The details of the acquisition are as follows:

Assets acquired:

Inventories $44,000 (fair value $38,000)

Building 200,000 (fair value $170,000)

Liability Assumed:

Bank Loan $10,000 (fair value $10,000)

Cost of acquisition:

Cash $250,000 (to be paid 30/9/2012 - funded by increasing Commotion Ltd's Bank Loan)

Legal fees $7,000 (to be paid 31/7/2012.

The directors of Commotion Ltd require this acquisition to be included in the financial statements at 30 June 2012

l) At 30 June 2012 directors confirm that the asset Debentures in Ryco Ltd is impaired and will realise only $120,000 due to the liquidation of Ryco Ltd. An adjustment is required for the 2012 financial statements.

Required

i) Prepare the required adjustments to the trial balance data at 30 June 2012 (in journal entry form)

ii) Prepare a statement of comprehensive income ( using classification of expenses by function method), a statement of financial position and a statement of changes in equity, including any required notes for the year ended 30 June 2012. These statements are to comply with Australian accounting standards AASB3, AASB101, AASB108,AASB110 and AASB116

PART B

With reference to Accounting Standard AASB110 'Events After the Reporting Period':

a) Explain the distinction between adjusting and non-adjusting events

b) Discuss the requirements under the standard for the disclosure of events after the reporting period