Reference no: EM131537988

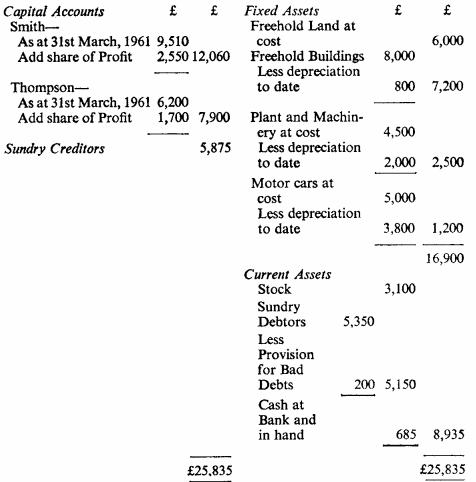

Question: Smith and Thompson are partners in a Manufacturing Business sharing profits and losses in the following proportions: Smith: three-fifths. Thompson: two-fifths. A draft Profit & Loss Account for the year ended 31st March, 1962, and a Balance Sheet at that date have been prepared. The Balance Sheet was as follows:

Re-printed by courtesy of the Association of Certified Accountants (A.C.C.A.).

On each of the fixed asset accounts in the books of the firm the "cost" is brought down at the end of the year as a debit balance, and the "total depreciation to date" is brought down as a credit balance. Depreciation is charged "Straight Line" as follows:

Freehold Buildings 2%

Plant 10%

Motorcars 20%

Depreciation is charged in the year of purchase, but not on assets sold or scrapped during the year. In the course of your examination of the books and accounts of the firm for the year ended 31st March, 1962, you discover the following:

(a) A small building costing £50 erected in the year to 31st March, 1954, has been demohshed. No adjustment has been made to the Asset Account except that depreciation has not been charged on the £50 in the year to 31st March, 1962.

(b) A machine costing £420 in December, 1954, had been sold in December, 1961, and the proceeds of sale £275 have been credited to Sales Account.

(c) The Motor Car Account has been debited during the year with 9 monthly instahnents of £60 each in respect of a new motor van, which has been purchased under a hire-purchase agreement. An exammation of the agreement revealed that the cash price was £960, and the hire-purchase price was £1,080, payable in eighteen equal monthly instahnents of £60, the first mstalment being paid 1st July, 1961. (Hire-Purchase Interest to 31st March, 1962-£80).

(d) Weekly drawings of £25 by each partner had been debited to Wages Account.

(e) As a result of an examination of the Sales Ledger balances it was decided that a debit of £73 should be specifically reserved in addition to the general reserve for bad debits of £200.

After making the necessary adjustments arising from the above, you are required to show:

1. The Fixed Asset Accounts for the year ended 31st March, 1962, as they would appear in the books of the firm, and

2. The revised Balance Sheet as at 31st March, 1962.