Reference no: EM131525740

Question: The Town of Frostbite self-insures for some of its liability claims and purchases insurance for others. In an effort to consolidate its risk management activities, the Town recently decided to establish an internal service fund, the Risk Management Fund. The Risk Management Fund's purpose is to obtain liability coverage for the Town, to pay claims not covered by the insurance, and to charge individual departments in amounts sufficient to cover currentyear costs and to establish a reserve for losses. The Town reports proprietary fund expenses by object classification using the following accounts: Personnel services (salaries), Contractual services (for the expired portion of prepaid service contracts), Depreciation, and Insurance Claims. The following transactions relate to the year ended December 31, 2012, the first year of the Risk Management Fund's operations.

1. The Risk Management Fund is established through a transfer of $500,000 from the General Fund and a long-term advance from the water utility enterprise fund of $250,000.

2. The Risk Management Fund purchased (prepaid) insurance coverage through several commercial insurance companies for $200,000. The policies purchased require the Town to self-insure for $25,000 per incident.

3. Office Equipment is purchased for $10,000.

4. $450,000 is invested in marketable securities.

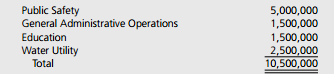

5. Actuarial estimates were made in the previous fiscal year to determine the amount necessary to attain the goal of accumulating sufficient funds to cover current-year claims and to establish a reserve for losses. It was determined that the General Fund and water utility be assessed a fee of 6 percent of total wages and salaries (Interfund premium). Wages and salaries by department are as follows:

6. Cash received in payment of interfund premiums from the General Fund totaled $275,000 and cash received from the Water Utility totaled $100,000.

7. Interest and dividends received totaled $27,000.

8. Salaries for the Risk Management Fund amounted to $200,000 (all paid during the year).

9. Claims paid under self-insurance totaled $150,000 during the year.

10. The office equipment is depreciated on the straight-line basis over 5 years.

11. At year-end, $190,000 of the insurance policies purchased in January had expired.

12. The market value of investments at December 31 totaled $456,000 (Hint: credit Net Increase in Fair Market Value of Investments ).

13. In addition to the claims paid in entry 9 above, estimates for the liability for the Town's portion of known claims since the inception of the Town's self-insurance program totaled $90,000.

Required:

a. Prepare the journal entries (including closing entries) to record the transactions.

b. Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Assets for the year ended December 31, 2012, for the Risk Management Fund

c. Prepare a Statement of Net Assets as of December 31, 2012, for the Risk Management Fund.

d. Prepare a Statement of Cash Flows for the year ended December 31, 2012, for the Risk Management Fund. Assume $10,000 of the transfer from the General Fund was for the purchase of the equipment. Further, assume the remainder of the transfer from the General Fund and all of the advance from the enterprise fund are to establish working capital (noncapital related financing).

e. Comment on whether the interfund premium of 6 percent of wages and salaries is adequate.