Reference no: EM131973776

Question: 1. The DuPont formula defines the net return on shareholders' equity as a function of the following components:

Operating margin

Asset turnover

Interest burden

Financial leverage

Income tax rate

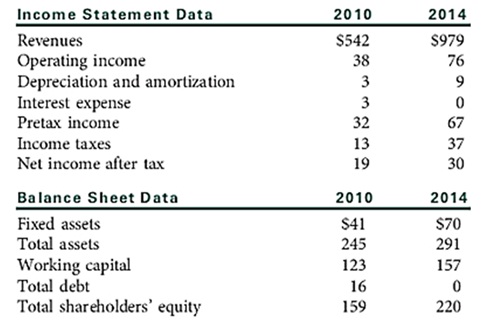

Using only the data in the table shown below:

a. Calculate each of the five components listed above for 2010 and 2014, and calculate the return on equity (ROE) for 2010 and 2014, using all of the five components. Show calculations.

b. Briefly discuss the impact of the changes in asset turnover and financial leverage on the change in ROE from 2010 to 2014.

2. David Wright, CFA, an analyst with Blue River Investments, is considering buying a Montrose Cable Company corporate bond. He has collected the following balance sheet and income statement information for Montrose as shown in Exhibit 10.10. He has also calculated the three ratios shown in Exhibit 10.11, which indicate that the bond is currently rated "A" according to the firm's internal bond-rating criteria shown in Exhibit 10.13. Wright has decided to consider some off-balance-sheet items in his credit analysis, as shown in Exhibit 10.12. Specifically, Wright wishes to evaluate the impact of each of the off-balance-sheet items on each of the ratios found in Exhibit 10.11.

a. Calculate the combined effect of the three off-balance-sheet items in Exhibit 10.12 on each of the following three financial ratios shown in Exhibit 10.11.

i. EBITDA/interest expense

ii. Long-term debt/equity

iii. Current assets/current liabilities

The bond is currently trading at a credit premium of 55 basis points. Using the internal bond-rating criteria in Exhibit 10.13, Wright wants to evaluate whether or not the credit yield premium incorporates the effect of the off-balance-sheet items.

b. State and justify whether or not the current credit yield premium compensates Wright for the credit risk of the bond based on the internal bond-rating criteria found in Exhibit 10.13.

3. Over the long run, you expect dividends for BBC in Problem 4 to grow at 8 percent and you require 11 percent on the stock. Using the infinite period DDM, how much would you pay for this stock?

4. The Shamrock Dogfood Company (SDC) has consistently paid out 40 percent of its earnings in dividends. The company's return on equity is 16 percent. What would you estimate as its dividend growth rate?

5. What P/E ratio would you apply if you learned that SDC had decided to increase its payout to 50 percent? (Hint: This change in payout has multiple effects.)