Reference no: EM131521759

Question: On January 1, 2012, White Water issues $500,000 of 6% bonds, due in 20 years, with interest payable annually on December 31 each year.

Required: Assuming the market interest rate on the issue date is 5%, the bonds will issue at $562,311.

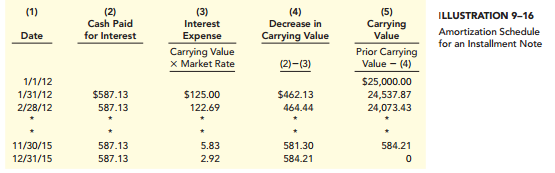

1. Complete the first three rows of an amortization table. (Use Illustration, except the dates for the first three rows will be 1/1/12, 12/31/12, and 12/31/13 since interest is payable annually rather than semiannually. Interest expense for the period ended December 31, 2012, is calculated as the carrying value of $562,311 times the market rate of 5%.)

2. Record the bond issue on January 1, 2012, and the first two interest payments on December 31, 2012, and December 31, 2013.

|

Prepare an instructional explanation that will help beth

: Prepare an instructional explanation that will help Beth understand the role of vertical integration in channel design and present your analysis.

|

|

Number of american voters

: Use the frequency? distribution, which shows the number of American voters? (in millions) according to? age, to find the probability that a voter

|

|

How should frank deal with the president

: Is there an ethical problem here? If so, what the right thing to do? How should the employees be treated? How should Frank deal with the president

|

|

Confidence interval for the population mean

: The 98% confidence interval for the population mean (rounded to two decimal places) is Lower Limit = Upper Limit =

|

|

Discuss the first two interest payments on december

: On January 1, 2012, White Water issues $500,000 of 6% bonds, due in 20 years, with interest payable annually on December 31 each year.

|

|

How the current state of the economy will impact

: Write a 500-750-word essay that discusses how the current state of the economy will impact completing an environmental scan.

|

|

People earned less than what amount

: In our survey, 25% of the people earned less than what amount?

|

|

Describes how companies have addressed significant changes

: Describes how companies such as Hewlett Packard, IBM, Kodak, and McDonald's have addressed significant changes within their organizations

|

|

Show that the bonds have a carrying value

: On January 1, 2012, Splash City issues $400,000 of 8% bonds, due in 15 years, with interest payable semiannually on June 30 and December 31 each year.

|