Reference no: EM13505233

Question 1

Accounting for share capital

The constitution of Hill Ltd indicated that the company could issue up to 5,000,000 ordinary shares and 1,000,000 preference shares. Prospectuses had been published offering 1,000,000 preference shares at $1.50 payable in full on application by 31 March 2013, and 2,000,000 ordinary shares at $1.20 with 50% due on application by 31 March 2013, 25% due on allotment, and 25% due on a call to be made by the directors at a later date.

By 31 March 2013, the company had received amounts due on 800,000 of the preference shares and on applications for 2,400,000 ordinary shares. The directors met on 10 April 2013 and resolved to issue the preference and ordinary shares.

The ordinary shares were allotted to applicants on a pro rata basis and the amounts received in excess of that due were to be credited against amounts due on allotment. The amount due on the allotment of the ordinary shares was payable by 15 May 2013 and this was received on all shares.

The directors made the call on the ordinary shares on 31 August 2013, with amounts payable by 30 September 2013. By this date, amounts due on 1,997,000 shares had been received. On 5 October 2013, as provided by the company's constitution, the directors forfeited the shares on which calls were unpaid.

On 25 October 2013, the forfeited shares were reissued as fully paid for a consideration of $1 per share. Costs of reissue amounted to $700. The constitution provided for any surplus on resale, after satisfaction of unpaid calls and costs, to be returned to shareholders whose shares were forfeited.

Required:

Provide the journal entries to account for the above entries. Show all relevant dates, narrations and workings.

Question 2

Accounting for income tax

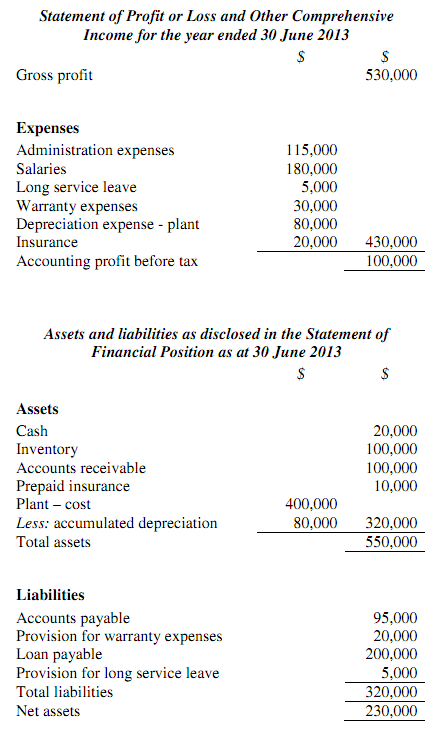

Bright Ltd commences operations on 1 July 2012 and presents its first Statement of Profit or Loss and Other Comprehensive Income, and first Statement of Financial Position on 30 June 2013. The statements are prepared before considering taxation. The following information is available:

Other information:

• All administration and salaries expenses incurred have been paid as at year end.

• None of the long service leave expense has actually been paid. It is not deductible until it is actually paid.

• Warranty expenses were accrued and, at year end, actual payments of $10,000 had been made (leaving an accrued balance of $20,000). Deductions are available only when the amounts are paid and not as they are accrued.

• Insurance was initially prepaid to the amount of $30,000. At year end, the unused component of the prepaid insurance amounted to $10,000. Actual amounts paid are allowed as a tax deduction.

• Amounts received from sales, including those on credit terms, are taxed at the time the sale is made.

• The plant is depreciated over five years for accounting purposes, but over four years for taxation purposes.

• The tax rate is 30%.

Required:

a) Determine the balance of any current and deferred tax assets and liabilities as at 30 June 2013, in accordance with AASB 112. Show all necessary workings.

b) Prepare the journal entries to record the current tax liability and movements in deferred tax assets and liabilities.

Question 3

Intangible assets

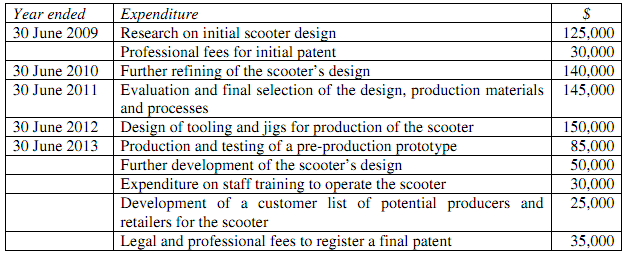

Scooters Ltd was incorporated five years ago on 1 July 2008. In the five years since then, the company has been developing a design for a new four-wheel motorised scooter for elderly persons. The company has patents pending for the design and production of the scooter.

By 30 June 2011, the company's work on the scooter design was sufficiently advanced for it to consider that the design was technically feasible and would results in a far superior product to any other motorised scooter available at that time. The company concluded at that time that it possessed sufficient resources to complete the development of the scooter's design.

The company has incurred the following expenditure in developing its scooter design over the past five years:

Required:

Discuss the accounting treatments for the expenditure incurred by Scooter Ltd in the last five years in accordance with AASB138. Provide relevant paragraph numbers from the standard to support your answer.

Question 4

Property, plant and equipment

Gardiner Ltd acquired a machine on 1 July 2011 at a cost of $300,000. At the date of acquisition, Gardiner's directors determine to depreciate the machine on a straight-line basis over a period of six years. The machine has an estimated residual value of nil. The company elects to adopt the revaluation model subsequent to acquisition.

The directors of Gardiner estimated the fair values for the machine to be $265,000 and $190,000 on 30 June 2012 and 30 June 2013 respectively. There are no changes in the originally estimated useful life and residual value for the machine.

Assume a tax rate of 30%.

Required:

Prepare journal entries to account for the above transactions for the years ended 2012 and 2013.