Reference no: EM131065132

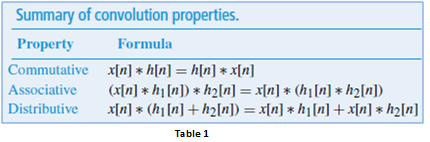

1. The properties of convolution is listed in the table 1; Verify the properties of convolution for the given signal by:

x[n]=n{u[n-10]-u[n+15]}

h[n]=(0.5)n {u[n]-u[n-10] }

h1 [n] = cos(0.05πn) {u[n]-u[n-21]}

h2 [n] = 2δ[n+3]+δ[n-1]-3δ[n-5].

a) Numerical computation of convolution sum.

b) Verify the result obtained in part(a) by using MATLAB function convand plot the output of each property.

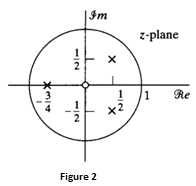

2. a) The pole - zero diagram in figure 2 corresponds to the Z-transform [X(z)] of a causal sequence (x[n]). Sketch the pole-zero diagram of Y(z), where y[n] = x[-n+5]. Also, determine the region of convergence for Y(z).

b) Discuss the applications of Multirate Digital Signal processing or Explain the need of Multirate Signal Processing with suitable Example.

Note: Support your answers with appropriate explanation and figures. Provide references also.

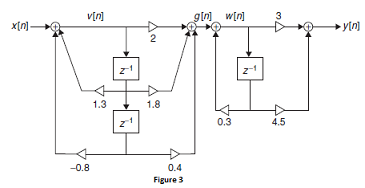

3. Given the realization of IIr filter in Figure 3.

a) Obtain the difference equation relating g[n]to x[n] and g[n] to y[n].

b) Determine the transfer function H(z)for the filter.

4. In this problem use Lena image to compute the output.

a) Load the Lena image in MATLAB and display using imshow function.

b) Consider the 1D (single dimensional) impulse response Using it performs 1D convolution along the each row of the Lena image and display the resulting blurred image. Comment on the result.

Using it performs 1D convolution along the each row of the Lena image and display the resulting blurred image. Comment on the result.

c) Using the image obtained in part (b) perform 1D convolution along the each column of the Lena image and display the resulting blurred image. Compare this image with the image in part (b) and comment on the results.

|

What is the real user cost of the building

: A firm just purchased a building that cost $5 million. The nominal mortgage interest rate is 5% per annum, mortgage interest payments are tax deductible, and the firm is in a 20% tax bracket. The expected inflation rate is 3%. Maintenance expenses ar..

|

|

What required return must investors be demanding

: Storico Co. just paid a dividend of $1.50 per share. The company will increase its dividend by 20 percent next year and will then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent divid..

|

|

What was the annual return to an investor

: On January 1, 2012 the common stock for Collins Corporation had a market value of $28.00. At December 31, 2012, the market value had increased to $32.00. During the year, Collins Company paid a cash dividend of $3.00. What was the annual return to an..

|

|

Value of european-style option given put-call parity

: Kevin examines both American- and European-style options that have the same stock, expiration date, and strike price. Kevin argues that the European-style option will be sold at a higher price than the American-style option. Calculate the value of a ..

|

|

Discuss applications of multirate digital signal processing

: Discuss the applications of Multirate Digital Signal processing or Explain the need of Multirate Signal Processing with suitable Example

|

|

Prepare communication plan for continuous change management

: BSB10178-6 - Prepare an Communication Plan for continuous change management for both employees and managerial performance at the Australian coal mine. Present the plan in tabular form with textual explanation.

|

|

Make four quarterly payments to retire the loan

: Zerox Copying Company plans to borrow $174,000. New Jersey National Bank will lend the money at one-half percentage point over the prime rate at the time of 13.50 percent (14 percent total) and requires a compensating balance of 20 percent. What woul..

|

|

Design a portfolio that properly suited for the young couple

: Your job is to design a portfolio that will be properly suited for this young couple for the next 5-10 years. Assume that liquidity is not an issue, and that all interest and dividends will be reinvested.

|

|

Compute the yield to maturity

: Bonds issued by the Coleman Manufacturing Company have a par value of $1,000, which of course is also the amount of principal to be paid at maturity. The bonds are currently selling for $590. They have 10 years remaining to maturity. The annual inter..

|