Reference no: EM132333631

Assessment: Business Case

The assignment is based on the case information below. While the company and financial data in the case are fictitious1, the context is not. Many companies face similar investment decisions as well as challenges and opportunities to run more environmentally and socially responsible businesses.

DuoLever Limited operates in the personal care (e.g. skin and hair care products) industry. All its products are sold in plastic packaging and a significant proportion in multi-layer sachets (or pouches)2.

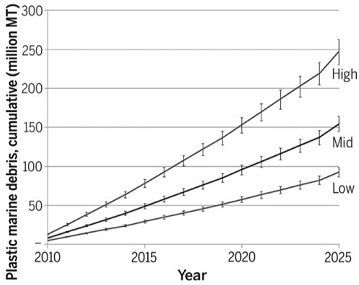

Managers at DuoLever are acutely aware of the increase in world production of plastic and the environmental impact of plastic waste ending up in landfills, rivers and oceans. For example, it is estimated that 8 million metric tons entered the ocean in 2010 and this annual amount is predicted to more than double by 2025, accumulating as show in the following graph3:

To help develop a closed-loop system related to the company's products, DuoLever has invested around $50 million in soft plastic recycling research, development and pilot testing. The outcome is a new and efficient method for recycling sachet waste. In fact, their recycling method is more energy efficient than producing virgin sachet plastic, reducing energy usage by 83%. The output plastic is of such high quality it can be used in food grade packaging applications. Currently, no other recycling method in the market can achieve this.

The company now faces a decision: should it (1) add production of recycled sachet plastic to the company's portfolio of businesses or (2) license use of the patented method? The CEO has asked you to undertake a financial analysis of the options and present your recommendations in a short memo.

Option 1:

The recycling production option requires an upfront investment in plant and equipment of $20 million, which will be depreciated to a zero book value on a straight-line basis over 5 years. The plant will provide sufficient capacity to meet the company's forecast plastic packaging needs over the period of its life. After this, it is expected that the plant will have no salvage value and will be updated using new and better technology. Financing for the plant and equipment will be via a new 5 year debt issue, resulting in interest costs of $1.4 million payable at the end of each year.

Producing recycled plastic has several financial benefits for the company. First, sales revenue of the company's existing products, which will be packaged in the recycled plastic, is predicted to increase due to consumer demand for environmentally responsible products. Excluding this benefit, the company's forecast sales revenue for the coming year is $200 million and this is expected to grow by 4% each year after that. The benefit of recycled packaging is expected to increase these sales forecasts 2% during the 5 year life of the project.

The second benefit is that the cost of plastic packaging for the company's existing products will decrease. The recycled plastic will be cheaper than buying virgin plastic due to lower energy costs and avoiding a supplier margin. The reduced energy costs will shave 15% off total variable packaging costs, currently (without recycling) estimated at $22 million for the coming year and expected to grow by 3% per year after that. Avoiding a supplier margin will reduce total variable packaging costs by 10%. However, the benefits of avoiding the current supplier margin will be offset by the need to pay a new partner, Clean World Ltd, who will set up a plastic waste collection system to supply sufficient raw material for the recycling plant. Apart from these changes, it is expected that variable costs and net working capital will be equivalent to existing forecasts. However, an additional $2 million annually in selling, administrative and general expenses directly related to the project (excluding depreciation) will be incurred.

Option 2:

Option 2 involves licensing use of the patented recycling method to another company, Clean World Ltd, which has shown interest in taking on the entire project, not just supply of raw material. Initial negotiations between DuoLever and Clean World have reached some agreement on what the terms of the arrangement would involve. Clean World would produce recycled plastic using DuoLever's method for the next 5 years and all output during that time would be supplied exclusively to DuoLever for the same cost as DuoLever's existing virgin plastic supply forecasts. This means that Clean World would capture the energy savings associated with the new recycling method, along with a supplier margin. The benefits for DuoLever would be no initial outlay for plant and equipment and locked in packaging materials supply costs for the next 5 years. DuoLever would also retain the ability to market the environmentally responsible characteristics of its recycled packaging and so retain the expected additional sales revenue benefits of Option 1. Annual selling, administrative and general expenses would be just $1 million annually under Option 2, as no additional production administration would be required.

Other information:

DuoLever has an 8% weighted average cost of capital and is subject to a 25% tax rate on its income.

Required:

Prepare a spreadsheet financial analysis of the proposed options and a memo to DuoLever's CEO that briefly explains and justifies your chosen methods, inputs and any assumptions made, summarises your findings, and presents your recommendations on the proposed options. Ensure you not only address base case cash flows but also analyse potential uncertainty. Recommendations should address the decision to be made, along with any further follow up or other matters the company should consider prior to making a final decision.

Instructions:

Submit your spreadsheet separately in the provided spreadsheet link in the BCS2 section of the unit site. By submitting the spreadsheet, you are confirming that it is entirely your own work. Save the spreadsheet with your details in the file name using the following format (failure to do so could result in your spreadsheet not being considered in marking):

The memo will be submitted as a word document via a Turnitin assignment link in the BCS2 section of the unit site and include your name, student ID, unit code (ACC00716), assessment number (A3) and word count at the beginning of the document. The remainder of the document should be set up as a formal memo and include an appendix with a screen shot(s) of your base case figures from the spreadsheet. Within the memo body, you may provide tables and figures that are discussed in the text and assist decision makers understand your methods, findings and their implications for decision making. The word document submission must not exceed 1,000 words (excluding the screen shot appendix and reference list).

This is an individual assessment exercise. The unit teaching team is very experienced at marking such assessments and recognising the differences between individual and "group" work, as well as data, facts, statements and ideas of others that have not been appropriately acknowledged. To avoid any potential for academic misconduct investigation, ensure that every aspect of your work is your own and that you acknowledge all sources you have directly drawn upon in your submitted work. Quotations should be shown as such. We are not fussy about referencing style, just that you reference when needed.

Use Harvard referencing style

Attachment:- business case studies.rar