Reference no: EM133201590

Assignment:

1. A school district is trying to determine exactly how many school buses to hire for the academic year and how much it will cost. The supply of school buses is represented by Ps = 4,000 + 8Qs and the district's demand for school buses is represented by Pd = 10,000 - 2Qd.

a) Find the equilibrium price and quantity.

b) Find the consumer and producer surpluses associated with this equilibrium.

c) Now suppose that only half of the buses needed by the school district are actually available for hire. At that quantity, how much would the school district be willing to pay for each bus? Identify the new producer and consumer surpluses at this price and quantity.

d) Using the prices and quantities demanded you found in parts a and c, calculate the price elasticity of demand for buses using the mid-point formula.

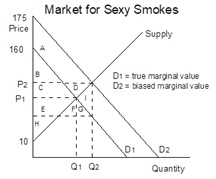

2. Firms sometimes hide negative effects of a product from the consumer, thereby creating a biased demand curve and a market result which is both inefficient and unfair. In the sexy cigarette market, consumers think the total value of the product is consistent with demand D2, but they have been fooled. The true value of the product is seen in demand curve D1.

True demand is P = 160 -2Q

Perceived demand is P = 175 - 2Q

Supply is P = 10 + Q.

a) Find the price, quantity, and the dollar values of the consumer and producer surplus in a market with perfect information (true demand). Also find the net gains.

b) Now find the price, quantity, along with the dollar values of the consumer and producer surplus and the deadweight loss when the consumers are being fooled. See Figure 4-7 in the text for a view of the consumer and producer surplus for this type of problem.

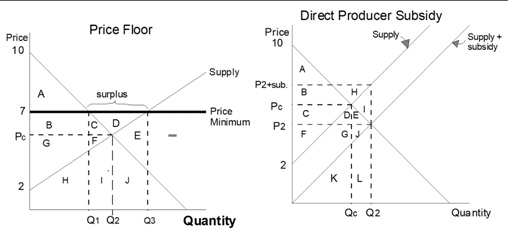

3. Let's consider the welfare effects of agricultural support programs using a numerical example. Assume that the government is considering three general types of subsidies, (1) a price floor plus the government purchase of all surplus grain, (2) a price floor plus government payments to farmers to grow nothing and (3) direct government subsidy payments to farmers. Assume that the demand curve is Pd = 10 - Qd, the supply curve is Ps = 2 + Qs, the price floor is at $7, and the direct subsidy is $2 per bushel.

a) Identify by letters in the Price Floor graph below the consumer surplus, producer surplus, government surplus, and total net gains for the competitive equilibrium and price floor programs (1) and (2) listed in this question. (Hint: They have very different deadweight losses). Do the same for the subsidy program in the Direct Producer Subsidy graph below.

b) Based on the equations above, find the equilibrium P and Q, and the dollar values of the consumer surplus, producer surplus, and net gains for this market without government intervention.

c) Find the dollar values of the consumer surplus, producer surplus, and (negative) government surplus for all three programs. Find the key points in each graph first. What is the dollar value of the deadweight loss, compared to the net gains in part A, for each type of subsidy?

4. Suppose that 20 million Americans talk on cell phones while driving during the typical week. The U.S. government is seeking to reduce this number. Three options are being considered: (1) Ban cell phone use in cars. This policy would cost $2 million and be 40% effective. (2) Require car makers to install cell phone blocking technology, which costs $10 million and is 85% effective. (3) Launch a public service campaign educating drivers about the risks of cell phone use while driving. This would cost $3 million and be 30% effective.

a) Which of the three plans would be most cost effective? Calculate the number who stop calling per dollar spent to determine your answer.

b) What additional steps should be considered in designing a more complete policy analysis of these choices?

5. Malcolm, the mayor of Schlafenberg, is being asked to choose the best among three proposals for a new water treatment plant. Plan A will cost $3 million to construct, purify $2 million worth of water per year, and lead to $1 million in operating costs per year. Plan B will cost $4 million to construct, purify $3 million worth of water, and result in $1.5 million in annual operating costs. Plan C, proposed by the mayor's son, will cost $7 million to construct, purify $4.5 million worth of water, and result in $2.5 million of operating costs per year. Assuming that each proposal will last for 5 years, find the present values of each using a 7 percent discount rate. Which policy would you recommend?