Reference no: EM132583662 , Length: word count:800

Question 1

Qalal Ltd manufacture quality dining tables to customers' specification. It has three production departments and two service departments.

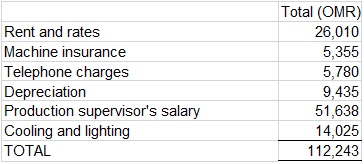

Budgeted overhead costs for the coming year are as follows:

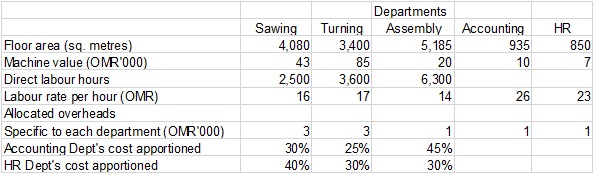

The three production departments: Sawing, Turning and Assembly, and the two service departments: Accounting and HR are housed in a single factory premise, the details of which, together with other statistics and information, are given as follows:

(a) Required:Prepare a statement showing the overhead cost budgeted for each department, reflecting the basis of apportionment used. Also, calculate suitable overhead absorption rates.

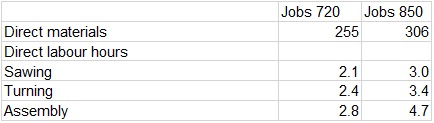

(b) Twoorders are to be manufactured for customers. Direct costs are as follows:

Required:Calculate total cost of each job.

Question 2

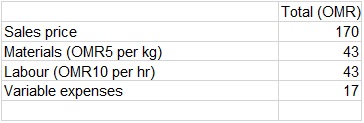

Jamal Abdul Ltd currently produces product A. The selling price and cost per unit of this product are as follows:

Currently fixed overheads are £130,000 and Jamal Abdul budgets to sell 12,500units of product A

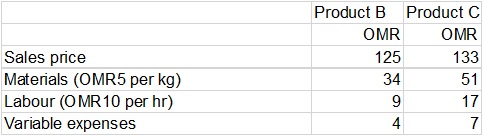

Jamal Abdul Ltd is considering introducing two new products onto the market. This would involve incurring additional fixed overheads of £20,500. The selling prices and cost per unit of these products are as follows:

Jamal Abdul Ltd has adequate labour, but materials are limited to only 37,500kgs. All three products use the same materials.

Required:

a) Calculate budgeted profit if only product A is produced.

b) Calculate the current breakeven point in units if Jamal Abdul Ltd produces only product A.

c) Explain why calculating the break-even quantity and margin of safety are important,for decision-making, to management.

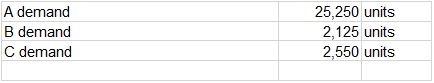

d) Market research has been carried out by Jamal AbdulLtd and that suggests that Jamal Abdul Ltd could sell the following quantities of products A,B and C

Assuming Jamal Abdul Ltd goes ahead with the introduction of products B and C, rank the three products so as to maximize profits given the shortage of materials.

e) Assuming Jamal AbdulLtd introduces products B and C, prepare a production plan, and determine total profits assuming profits are maximized.

Question 3

Traditional costing systems have been used to determine selling prices for centuries. Marginal costing has helped businesses to decide on product mix and production prioritisation.

Required:

Critically evaluate the scenarios where these systems would be most appropriate and provide examples to support those scenarios.

Question 4

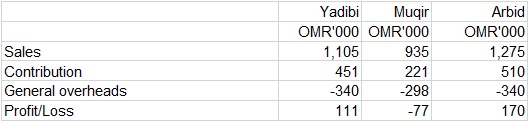

ATC Company Ltd operates 3 outlets in Sisala. Whilst overall, the company is profitable; the outlet in Muqir continues to make losses. The directors are currently considering their options and have requested you to advise them.

Additional information:

Management has advised that 45% of the general overhead of the company is fixed and is apportioned to the outlets on the basis of sales turnover. Since all of these outlets are in locations far away from each other, it is anticipated that sales will not be affected at the remaining outlets if any of the outlets were to discontinue operations.

Required:

(a) Calculate the profitability of the company if the Muqir outlet was to be closed.

(b) Based on your calculations, would you advise the management of ATC Company Ltd. to close the Muqir shop? Explain why.

(c) What possible factors could be causing the losses in the Muqir outlet?

(d) Critically discuss any further quantitative or qualitative aspects that should be taken into account before a final decision is made to close the Muqir outlet.

Question 5

Activity Based Costing (ABC) has been deployed extensively within the manufacturing environment with success in improving competitiveness. This has been particularly relevant in circumstances where multiple products are produced using a common set of fixed assets (machines) and the same labour force.

Critically discuss the relevance of ABC within services industries. Support your answer with appropriate examples.

Question 6

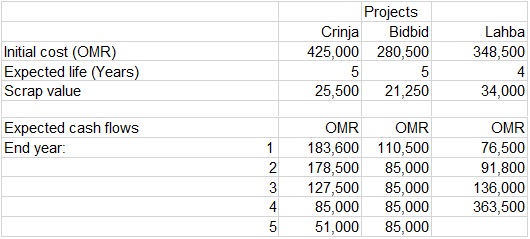

Secor Enginering Company (SEC) is considering an investment in one of 3 capital expenditure projects in different parts of Salaga. The information below relates to these 3 projects of which only one can be selected as a result of capital rationing.

SEC estimates that its weighted average cost of capital is 20% per annum and applies this discount rate to all projects being considered for consistency.

Required:

(a) calculate the payback period for each prospective project.

(b) calculate the accounting rate of return for each project.

(c) calculate the net present value for each project.

(d) based on the above information only, which project would be accepted and why?

(e) explain the factors that management would need to consider, in addition to the information calculated in (a)-(c) above.