Reference no: EM13530756

1. For the month of November, the beginning inventory of Product M is expected to be 2,000 cases. Expected sales are 10,000 cases, and the company wishes to begin the next period with an inventory of 1,000 cases. The number of cases of M that the company must purchase during

November is

a. 11,000 cases.

b. 10,000 cases.

c. 9,000 cases.

d. 13,000 cases.

2. XYZ Company projected unit credit sales for the last four months of the year as shown below:

September 3,000 October 3,200 November 4,100

December 5,600

The company's past records show collection of credit sales as 60% in the month of sale and the balance in the following month. If inventory units are sold for $25, the total cash collections in

November will be

a. $93,500.

b. $37,400.

c. $102,500.

d. $61,500.

3. Strategic Budgets focus on

a. short-range decisions.

b. intermediate-range decisions.

c. sales targets.

d. long-range decisions/plans.

4. A sales budget has been prepared for April. Management wants the amount of ending inventory each month to be equal to 10% of the next month's cost of goods sold. April cost of goods sold is projected at $80,000 and May cost of goods sold is projected at $60,000. Ending inventory at the end of March is expected to be $8,000. Based on this information, what would the amount of purchases be for April? a. $82,000

b. $86,000

c. $72,000

d. $78,000

5. When would a variance be labeled as favorable?

a. When standard costs are equal to actual costs

b. When standard costs are less than actual costs

c. When expected sales are greater than actual sales

d. When actual costs are less than standard costs

|

Use the following information to answer the next two questions:

The following budget information is available for the XYZ Company for the first quarter of 2011:

|

|

|

Sales ($16 per unit)

|

$320,000

|

|

|

Freight out

|

$.25 per unit sold

|

|

|

Depreciation on Administrative Equipment

|

$10,000

|

|

|

Sales & Admin. Salaries

|

$40,000 +2% of sales

|

|

|

Advertising

|

$12,000

|

|

|

Depreciation on Manufacturing Equipment $15,000

Lease on Sales Building $45,000

Miscellaneous Selling Expenses $5,000

|

All operating expenses are paid in cash in the month incurred.

6. If XYZ expects to sell 20,000 inventory units in the first quarter, what would be the amount of the total budgeted selling and administrative expenses for the first quarter of 2011? a. $123,400

b. $138,400

c. $113,400

d. $293,400

7. Based on first quarter sales of 20,000 units, the amount of XYZ's expected cash outflow for selling and administrative expenses would be a. $123,400.

b. $131,250.

c. $113,400.

d. $128,400.

|

Use the following information to answer the next two questions: National's cost accountant prepared the following static budget based on expected activity of 2,000 units for the 2011 accounting period:

|

|

|

Sales Revenue

|

$64,000

|

|

|

Variable Costs

|

(34,000)

|

|

|

Contribution Margin

|

30,000

|

|

|

Fixed Costs

|

(18,000)

|

|

|

Net Income

|

$12,000

|

8. If National actually produced 1,800 units, the flexible budget would show variable costs of a. $34,000.

b. $22,666.

c. $30,600.

d. $25,500.

9. If National actually produced 1,900 units, the flexible budget would show fixed costs amounting to a. $19,800.

b. $18,000.

c. $52,000.

d. none of the above.

|

Use the following information to answer the next two questions: Cox Manufacturing Company prepared the following static budget income statement for 2011:

|

|

|

Sales Revenue

|

$125,000

|

|

|

Variable Costs

|

(75,000)

|

|

|

Contribution Margin

|

50,000

|

|

|

Fixed Cost (30,000)

Net Income $ 20,000

|

|

The budget was based on an expected sales volume of 5,000 units. Actual sales volume was 6,000 units.

|

10. The amount of net income based on a flexible budget of 6,000 units is expected to be a. $24,000.

b. $26,000.

c. $30,000.

d. $45,000.

11. The sales revenue volume variance is

a. $25,000 favorable.

b. $10,000 unfavorable.

c. $4,000 unfavorable.

d. $6,000 favorable.

12. Marjorie Jewels, a maker of fashionable rings, produced and sold 6,000 rings during the recent accounting period. The company had expected to sell 5,600 rings. Because of competition, the company priced the rings at $20 each, $2 lower than the budgeted selling price. Based on this information, there is

a. a favorable $8,000 sales volume variance.

b. an unfavorable $800 total sales variance.

c. an unfavorable sales price variance.

d. all of the above

13. Which of the following is a difference between a static and a flexible budget?

a. Static budgets are based on single estimate of volume, whereas flexible budgets show estimated costs and revenues at a variety of activity levels.

b. Static budgets are based on the same per unit variable amount, whereas flexible budgets are based on multiple per unit variable amounts.

c. Static budgets use the same fixed cost amounts, whereas flexible budgets change the amount of fixed costs at different levels of activity.

d. None of the other answers are correct.

14. In which account is the cost of direct labor initially recorded?

a. Wages Expense.

b. Work in Process Inventory.

c. Manufacturing Overhead.

d. Cost of Goods Sold.

15. JCK had beginning work in process inventory of $8,000. During the period, JCK transferred $34,000 of raw materials to work in process. Labor costs amounted to $41,000 and overhead amounted to $36,000. If the ending balance in work in process inventory was $12,000, what was the amount transferred to finished goods inventory? a. $107,000.

b. $119,000.

c. $131,000.

d. $111,000.

16. The recognition of cash paid for wages of production workers will

a. decrease assets, equity, and net income.

b. not affect assets and decrease net income.

c. not affect assets, equity, or net income.

d. decrease assets and increase net income.

17. The cost of direct materials purchased on account is expensed when

a. the materials are purchased.

b. the cash is paid to settle the associated accounts payable.

c. the manufacturing process is complete.

d. the goods made with the materials are sold.

18. Product costs are expensed as cost of goods sold:

a. When production is complete.

b. At the start of production.

c. When the related revenue is collected.

d. When the related products are sold.

19. The cost of indirect labor will initially be charged to:

a. Cost of goods sold.

b. Manufacturing overhead.

c. Work in process.

d. Wages expense.

20. Product costs flow through the manufacturer's inventory accounts in the following order: raw materials, work in process, and finished goods. a. True

b. False

Extra Credit Problem

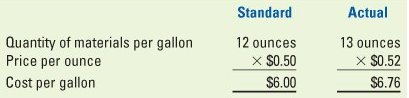

Howe Company makes paint that it sells in 1-gallon containers to retail home improvement stores. During 2012, the company planned to make 190,000 gallons of paint. It actually produced 198,000 gallons. The standard and actual quantity and cost of the color pigment for 1 gallon of paint follow.

Required

a. Determine the total flexible budget materials variance for pigment. Indicate whether the variance is favorable or unfavorable.

b. Determine the materials price variance and indicate whether the variance is favorable (F) or unfavorable (U).

c. Determine the materials usage variance and indicate whether the variance is favorable (F) or unfavorable (U).

d. Confirm your answers to Requirements a, b, and c by showing that the sum of the price and usage variances equals the total variance.