Reference no: EM132564691

HI5020 Corporate Accounting - Holmes Institute

Learning Outcome 1. Examine conceptual issues and the sources of authority for the accounting requirements which apply to reporting by Australian companies and corporate groups, including Company Law,

International and Australian Accounting Standards, and Stock Exchange requirements;

Learning Outcome 2. Critically analyse and interpret the financial statements and other disclosures produced by Australian companies and corporate groups;

Learning Outcome 3. Apply Australian Accounting Standards and Corporate Legislation to the financial reporting processes of a range of corporate forms including companies and joint ventures;

Learning Outcome 4. Evaluate financial accounting problems and select appropriate accounting strategies for the accounting entity;

Learning Outcome 5. Prepare accounting reports for companies and other corporate forms that meet the compliance requirements of the professional and legal bodies in Australia;

Learning Outcome 6. Make judgments about appropriate use of accounting standards and accurately apply appropriate treatments and communicate these outcomes to a diverse range of stakeholders.

Question 1

At 30 June 2019, Beta Ltd had the following deferred tax balances:

Deferred tax liability $18,000

Deferred tax asset 15,000

Beta Ltd recorded a profit before tax of $80,000 for the year to 30 June 2020, which included the following items:

Depreciation expense - plant $7,000

Doubtful debts expense 3,000

Long-service leave expense 4,000

For taxation purposes the following amounts are allowable deductions for the year to 30 June 2020: Tax depreciation - plant $8,000

Bad debts written off 2,000

Depreciation rates for taxation purposes are higher than for accounting purposes. A corporate tax rate of 30% applies.

Required:

a) Determine the taxable income and income tax payable for the year to 30 June 2020.

b) Determine by what amount the balances of the deferred liability and deferred tax asset will increase or decrease for the year to 30 June 2020 because of depreciation, doubtful debts and long-service leave.

c) Prepare the necessary journal entries to account for income tax assuming recognition criteria are satisfied.

d) What are the balances of the deferred tax liability and deferred tax asset at 30 June 2020?

Question 2:

On 1 July 2019, Quick Buck Ltd took control of the assets and liabilities of Eldorado Ltd. Quick Buck Ltd issued 80,000 shares having a fair value of $2.40 per share in exchange for the net assets of Eldorado Ltd. The costs of issuing the shares by Quick Buck Ltd cost $1,600.

At this date the statement of financial position of Eldorado Ltd was as follows:

|

|

Carrying amount

|

Fair value

|

|

Machinery

|

$40,000

|

$67,000

|

|

Fixtures & fittings

|

60,000

|

68,000

|

|

Vehicles

|

35,000

|

35,000

|

|

Current assets

|

10,000

|

12,000

|

|

Current liabilities

|

(16,000)

|

(18,000)

|

|

Total net assets

|

$129,000

|

|

|

Share capital (80,000 shares at $1.00 per share) $80,000

|

|

General reserve

|

20,000

|

|

Retained earnings

|

29,000

|

|

Total equity

|

$129,000

|

Required:

Prepare the journal entries in the records of Quick Buck Ltd at 1 July 2019 for the acquisition.

Question 3

a) Liala Ltd acquired all the issued shares of Jordan Ltd on 1 January 2015. The following transactions occurred between the two entities:

• On 1 June 2016, Liala Ltd sold inventory to Jordan Ltd for $12,000, this inventory previously costed Liala Ltd $10,000. By 30 June 2016, Jordan Ltd had sold 20% of this inventory to other entities for $3,000. The other 80% was all sold to external entities by 30 June 2017 for $13,000.

• During the 2016-17 period, Jordan Ltd sold inventory to Liala Ltd for $6,000, this being at cost plus 20% mark-up. Of this inventory, 20 % remained on hand in Liala Ltd at 30 June 2017. The tax rate is 30%.

Required:

(i) Prepare the consolidation worksheet entries for Liala Ltd at 30 June 2017 in relation to the intragroup transfers of inventory.

(ii) Compute the amount of cost of goods sold to be reported in the consolidated income statement for 2017 relating to the relevant intra-group sales.

b) On 1 July 2016, Liala ltd sold an item of plant to Jordan Ltd Ltd for $150,000 when its carrying value in Liala Ltd book was $200,000 (costs $300,000, accumulated depreciation $100,000). This plant has a remaining useful life of five (5) years form the date of sale. The group measures its property plants and equipment using a costs model. Tax rate is 30 percent.

Required:

Prepare the necessary journal entries in 30 June 2017 to eliminate the intra-group transfer of equipment. (4 marks)

Question 4:

Giant Ltd acquired 80 percent share capital of Expert Ltd. On 1 July 2018 for a cost of $1,600,000. As at the date of acquisition, all assets and liabilities of Expert Ltd were fairly valued except a land that has a carrying value $150,000 less than the fair value. The recorded balance of equity of Expert Ltd as at 1 July 2018 were as:

Share capital $800,000

Retained earnings $200,000

General Reserve $400,000

Total

Additional information: $1,400,000

• The management of Giant Ltd values non-controlling interest at the proportionate share of Expert Ltd identifiable net assets.

• Expert Ltd has a profit after tax of $200,000 for the year ended 30 June 2019.

• During the financial year to 30 June 2019, Expert Ltd sold inventory to Giant Ltd for a price of $120,000. The inventory costs Expert Ltd $60,000 to produce. 25 percent of the inventory are still on the hand of Giant Ltd as at 30 June 2019.

• During the year Expert Ltd paid $60,000 in consultancy fees to Giant Ltd.

• On 1 July 2018, Expert Ltd sold an item of plant to Giant Ltd $80000. The equipment had a carrying value of $60,000 (Cost $100,000, accumulated depreciation $40,000). At the date of sale, it was expected that the equipment had a remaining life of 4 years and no residual value.

• The tax rate is 30 percent.

Required:

a) Based on the above information, calculate the non-controlling interest as at 30 June 2019.

b) Prepare the necessary journal entries to recognise the non-controlling interest as at 30 June 2019.

Question 5

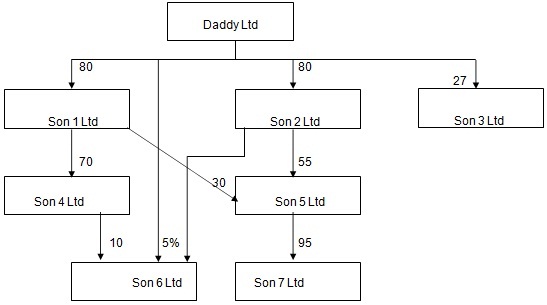

The Daddy Group has the following group structure:

(a) Reproduce and complete the following controlling and non-controlling interest table. Show your calculations.

(b) What percentage of the voting in Son 7 Ltd will be controlled by the Daddy Ltd?

(c) What percentage of the dividend declared by Son 7 Ltd will be received by the Daddy Ltd?

Attachment:- Tutorial Question Assignment.rar