Reference no: EM131992154

Question is asking you to determine the P/E ratio of a growth stock over a specific period of time. The specific period that is mentioned in this question is a period of 10 years, and then repeat this process for a period of 5 years. You are going to use a modified version of equation 14.31 that is presented on page 509 (my hard copy of book). This equation is designed to show you the time that a stock will be in the growth mode. That time is represented by 'T'. The modified version of the equation is spelled out on page 511 of my book and is as follows:

Ln(X) = T * ln [(1 + stock growth rate)/(1+ market growth rate)]

When you fine 'X', you multiply that times the given market multiple, and that will give you your P/E ratio for that time.

You are using a log (ln) because you are trying to find the inverse of an exponential growth rate.

Recall that for the first question, T is 10 and the growth rate of Lauren is .18 and the growth rate of the S&P is .08, and there are no dividends. So our equation will be:

ln (x) = 10 ln (1.18/1.08)

ln (x) = 10 ln (1.09259)

ln (x) = 10 (0.08855)

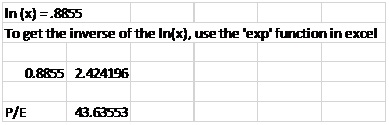

ln (x) = 0.8855

To get the ln(X), you can use the exponential

Function in excel. This is 'exp'

x = 2.424

To find the P/E ratio, multiply 2.424 times the market multiple of 18. This 43.6

Repeat this process for the T of 5 years to get the answer to 6b.