Reference no: EM131529868

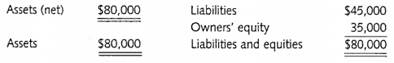

Question: This problem shows the importance of considering the importance of converting operating leases to capital leases for financial statement analysis. Itis based upon the techniques developed and illustrated in Imp off, Lippe, and Wright (1991 and 1997) though it is much simplified from their presentation. McAdoo Restaurants is a large franchise. Their balance sheet showed the following on December 31,2000 (in thousands).

Net income after taxes was $6,500 for 2001. McAdoo's marginal tax rate is 35 percent. On December 31,2000, McAdoo entered several major lease contracts. These leases were all for 10 years and were operating leases. Starting in 2001, total annual lease payments, due on each December 31, are $3,000. McAdoo's marginal cost of capital rate is 10 percent. No change in liabilities occurred during the year and there were no transactions with owners.

Required: a. Convert the operating lease to a capital lease which is 1year old (Hint: Use the present value of a 10-year ordinary annuity). Assume that straight-line depreciation is used for both book and tax purposes. There would be a zero salvage value.

b. Determine the net income after taxes if the leases are treated as capital leases.

c. Determine the return on -assets under the (a) operating lease assumption and (b) capital lease assumption.

d. Determine the debt-equity ratio under the (a) operating lease assumption and (b) capital lease assumption. c. Do you think it is useful to convert operating leases to capital leases for financial sarcomere analysis purposes? Discuss.