Reference no: EM132789465

Portfolio Optimization

(1) Show that l'h1 = 0.

(2) Is h0 ≥ 0? Prove or give a counter example.

(3) Show that h1 = 0 if µ is a multiple of l.

(4) Show that β1 = 0.

(5) Show that β2 = α1.

(6) Explain why, if µ = rl, we get σ2p = 0.

(7) Consider the inequality

r < µ' [Σ-1 l/l'Σ-1l]

(a) Derive the inequality.

(b) Explain its importance.

(c) Interpret the right-hand side as an expected value.

(8) We have two investors, named X and Y, with perfect market information. Each has invested a total of $100,000. Their aversion to risk is determined by their t values of tx and ty, respectively. Investor X's portfolio in the risky assets is given by

(a) How much has Investor X invested in the risk-free asset?

(b) Suppose that 20% of Investor Y's portfolio is invested in the first risky asset. How much has Investor Y invested in the risk-free asset?

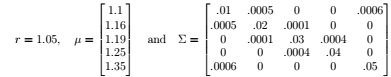

(9) Please summarize your answers to the given questions on paper separate from your rough work. Your rough work can be on paper or on a spreadsheet (that I can understand) that is e-mailed to me. Let

(a) Determine the parametric efficient portfolio x(t).

(b) Determine the expected value and the variance for x(t), that is, determine µp(t) and σp2(t).

(c) Determine the constants c1, c2, and c3 so that the efficient frontier is given by

σ2 = c1µp2 + c2µp + c3.

(d) What is (σˆ2, µˆ), the point on the efficient frontier corresponding to the minimum variance portfolio, on the variance-expected value coordinate system?

(e) What is (σˆ, µˆ), the point on the efficient frontier corresponding to the minimum vari-ance portfolio, on the standard deviation-expected value coordinate system?

(f) Determine the market portfolio xm and the corresponding values of σm and µm.

(g) Determine c4 and c5 so that the Capital Market Line is given by the equation

µp = c4 + c5σp.

Show that (σm, µm) is a point on the Capital Market Line.

(h) Find c6 and c7 so that the Security Market Line (SML) is given by

µi = c6 + c7 (cov(ri, rm)).

Show that, for i = 1, 2, 3, 4, 5, the point (Σixm, µi), where Σi is the i-th row of Σ, is on the SML. Show that xm is on the SML, that is, show that (σ2 , µm) satisfies your equation for the SML.

(i) Suppose that µm = 1.2. Determine the corresponding tm and σm. Determine an equation for the implied CML and determine the implied risk free return.

Attachment:- Portfolio Optimization.rar