Reference no: EM131318424

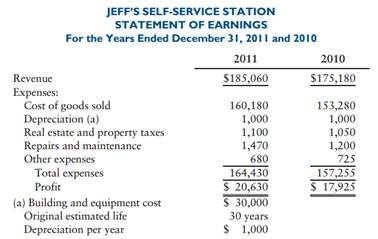

JEFF'S SELF-SERVICE STATION

John Dearden and his wife, Patricia, have been taking a vacation to Stowe, Vermont, each summer. They like the area very much and would like to retire someday in this vicinity. While in Stowe during the summer, they notice a "for sale" sign in front of a self-service station. John is 55 and is no longer satisfied with commuting to work in New York City. He decides to inquire about the asking price of the station. He is aware that Stowe is considered a good vacation area during the entire year, especially when the ski season is in progress. On inquiry, John determines that the asking price of the station is $70,000, which includes two pumps, a small building, and 1/8 acre of land.

John asks to see some financial statements and is shown profit and loss statements for 2011 and 2010 that have been prepared for tax purposes by a local accountant.

John is also given an appraiser's report on the property. The land is appraised at $50,000, and the equipment and building are valued at $20,000. The equipment and building are estimated to have a useful life of 10 years.

The station has been operated by Jeff Anderson without additional help. He estimates that if help were hired to operate the station, it would cost $10,000 per year. John anticipates that he will be able to operate the station without additional help. John intends to incorporate. The anticipated tax rate is 50%.

Required

a. Determine the indicated return on investment if John Dearden purchases the station. Include only financial data that will be recorded on the books. Consider 2011 and 2010 to be representative years for revenue and expenses.

b. Determine the indicated return on investment if help were hired to operate the station.

c. Why is there a difference between the rates of return in (a) and (b)? Discuss.

d. Determine the cash flow for 2012 if John serves as the manager and 2012 turns out to be the same as 2011. Do not include the cost of the hired help. No inventory is on hand at the date of purchase, but an inventory of $10,000 is on hand at the end of the year. There are no receivables or liabilities.

e. Indicate some other considerations that should be analyzed.

f. Should John purchase the station?