Reference no: EM13213753

Part A

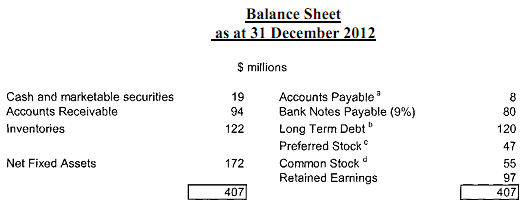

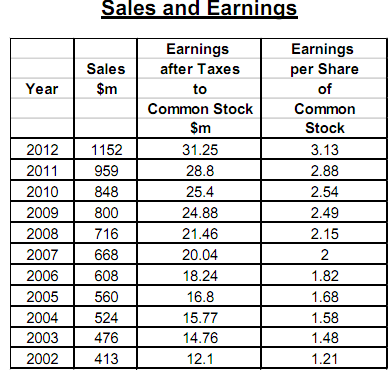

You have been directed to develop a cost of capital for the firm to use in evaluating 2013 capital investment projects. You have obtained the projected December 31, 2012 Balance Sheet as well as information on sales and earnings for the past ten years.

Notes

a) Accounts payable are exceptionally low because the firm follows the practice of paying cash on delivery in return for substantial purchase discounts.

b) The bonds outstanding have a par value of $1000, a remaining life of 15 years, and a coupon rate of 8 percent. The current rate of interest for bonds with the firm's rating is 10 percent per year. The bonds pay annual interest.

c) The preferred stock currently sells at its par value of $100 per share.

d) There are 10 million shares outstanding and the stock currently sells at a price of $24 per share.

You:

• believe the company's future growth to be only one half the rate experienced during the last decade.

• expect the firm to continue paying out about 60 percent of the earnings available to common in the form of cash dividends.

• Believe if expansion needs do not meet the required 40 percent retention rate, the payout ratio would be increased.

• believe that the mix of debt, common stock, and preferred stock that was optimum (that is, produced the lowest average cost-of-capital) was the one that the company presently employed. The proportions of this mix had been relatively stable over the past five years, and they were used to construct the projected December 31, 2012 Balance Sheet.

You have also asked the firm's investment banks and commercial bankers what the firm's cost of various types of capital would be, assuming that the present capital structure is maintained. This information yielded the following conclusions.

DEBT

Up to and including $4 million of new debt, the company can use loans and commercial paper, both of which currently have an interest rate of 10 percent.

For additional funds above $4 million but less than $10 million, the company can issue mortgage bonds with an Aa rating and an interest cost to the company of 12 percent on this increment of debt.

From $10 million to less than $14 million of new debt, the company can issue subordinated debentures with a Baa rating that would carry an interest rate of 13percent on this increment of debt.

At and over $14 million of new debt would require the company to issue subordinated convertible debentures. The after tax cost of these convertibles to the company is estimated to be 9 percent on this increment of debt.

PREFERRED STOCK

The company's preferred stock, which has no maturity since it is a perpetual issue, pays a $9 annual dividend on its $100 par value and is currently selling at par. Additional preferred stock in the amount of $2 million can be sold to provide investors with the same yield as is available on the current preferred stock, but flotation costs would amount to $4 per share. If the company were to sell a preferred stock issue paying a $9 annual dividend, investors would pay $100 per share, the flotation costs would be $4 per share, and the company would net $96.

For additional raisings of preferred stock above $2 million but less than $3 million, the after-tax, after flotation cost would be 10.5 percent for this increment of preferred stock.

For $3 million and over, of preferred stock; the after-tax, after flotation cost would be 13 percent for this increment.

Required

You are asked to answer the following questions

1. Determine the firm's existing market value capital structure. Disregard the minor amount of accounts payable. Also, lump notes payable in with long term debt. Round to the nearest whole percent.

2. Assuming that the firm maintains this optimum market value capital structure, calculate the breaking points in the Marginal Cost of Capital (MCC) schedule. Recall that the company is projecting $31.25 million of earnings available to common and a 60 percent dividend payout ratio.

3. Now calculate MCC in the interval between each of the breaking points and graph the MCC schedule in its step function form.

4. Estimate to the closest whole percentage point the missing internal rates of return in the investment schedule and then use the information developed thus far in the case to decide which projects should be accepted. Illustrate your solution technique with a graph and conclude your answer to this question with a discussion of the accept/reject decision on the marginal project.