Reference no: EM13907202

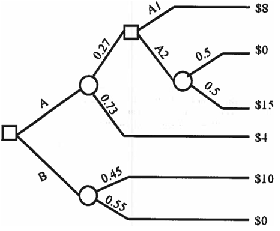

1. (a) Solve the decision tree shown below.

(b) Create risk profiles and cumulative risk profiles for all possible strategies. Is one strategy stochastically dominant? Explain.

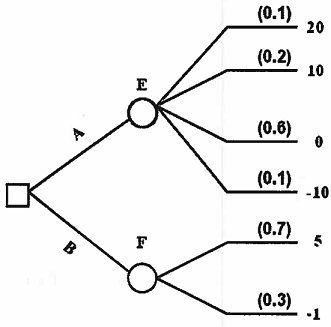

2. For the decision tree shown below:

(a) Determine the EVPI for chance event E only.

(b) Determine the EVPI for chance event F only.

(c) Determine the EVPI for both chance events E and F: that is, perfect information for both E and F is available before the decision is made.

(d) Do a sensitivity analysis on the probabilities for chance event F and explain/interpret your result.

3. A decision maker faces a risky gamble in which he/she may obtain one of five outcomes. The outcomes are labeled A, B, C, D, and E. Outcome A is the most preferred, and E is the least preferred. He/she has made the following three assessments:

(a) He/she is indifferent between having C for sure or a lottery in which he/she wins A with probability 0.5 or E with probability 0.5.

(b) He/she is indifferent between having B for sure or a lottery in which he/she wins A with probability 0.4 or C with probability 0.6.

(c) He/she is indifferent between these two lotteries:

1. A 50% chance at B and a 50% chance at D.

2. A 50% chance at A and a 50% chance at E.

What are U(A), U(B), U(C), U(D), U(E)?

4. Consider the following gamble:

Win $10 with probability 0.5

Win $40 with probability 0.5

(a) Using the above gamble, show that the logarithmic utility function, U(x) = ln (x), demonstrates decreasing risk aversion.

(b) Using the same reference gamble and a risk tolerance of $35, show that the exponential utility function, U(x) 1 - exp (-x/R), demonstrates constant risk aversion.

|

Common stock is expected to pay a dividend

: Crisp cookwares common stock is expected to pay a dividend of $3 a share at the end of the year (D1 = $3.00) its beta is 0.8, the risk free rate is 5.2% and the market risk premium is 6%. The dividend is expected to grow at some constant rate g, and ..

|

|

Describe the purpose of respiration

: Describe the purpose of respiration and the effect of oxygen availability on energy pathways.Describe the structure of mitochondria, identifying the location of each stage of aerobic respiration.Identify the reactants and products of glycolysis, desc..

|

|

What is a cash budget

: Piaggio prepares a cash budget. What is a cash budget?

|

|

Write a code for ludo game

: Write a C++ code ludo game C++ is a statically typed, compiled, general-purpose, case -sensitive, free -form programming language that supports procedural, object -oriented, and generic programming.

|

|

Determine the evpi for both chance events e and f

: Determine the EVPI for chance event E only. Determine the EVPI for chance event F only. Determine the EVPI for both chance events E and F: that is, perfect information for both E and F is available before the decision is made.

|

|

Should we have rules-based ethics standards

: Should we have rules-based ethics standards? Why or why not? Should they tell you exactly what to do in specific ethical situations?

|

|

Identify the reactants and products of glycols

: Identify the reactants and products of glycolysis, describing when and where ATP is used and synthesized.Identify the reactants and products of the formation of Acetyl-CoA and Krebs cycle, describing when and where ATP is used and synthesized.

|

|

What is the difference between a production budget

: 1. KTM regularly uses budgets. What is the difference between a production budget and a manufacturing budget?

|

|

Annotated bibliography developed over the course

: Annotated Bibliography developed over the course

|