Reference no: EM13182764

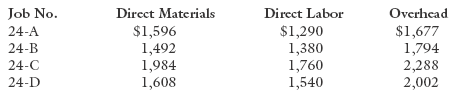

On May 31, the inventory balances of Princess Designs, a manufacturer of high-quality children's clothing, were as follows: Materials Inventory, $21,360; Work in Process Inventory, $15,112; and Finished Goods Inventory, $17,120. Job order cost cards for jobs in process as of June 30 had these totals:

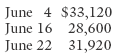

The predetermined overhead rate is 130 percent of direct labor costs. Materials purchased and received in June were as follows:

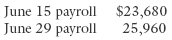

Direct labor costs for June were as follows:

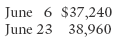

Direct materials requested by production during June were as follows:

On June 30, Princess Designs sold on account finished goods with a 75 percent markup over cost for $320,000.

Required:

1. and 4. Using T accounts for Materials Inventory, Work in Process Inventory, Finished Goods Inventory, Overhead, Accounts Receivable, Payroll Payable, Sales, and Cost of Goods Sold, reconstruct the transactions in June. Determine the ending balances. If required, round any amount to the nearest dollar.

EQUIVALENT PRODUCTION: FIFO COSTING METHOD

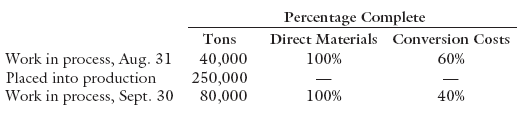

Paper Savers Corporation produces wood pulp that is used in making paper. The following data pertain to the company's production of pulp during September:

Compute the equivalent units of production for direct materials and conversion costs for September using the FIFO costing method.