Reference no: EM131792226

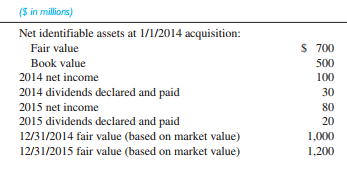

Question: On January 1, 2014, Newyork Capital Corporation purchased 30% of the outstanding common shares of Delta Crating Corp. for $250 million and accounts for this investment under the equity method. The following information is available regarding Delta Crating Corp.

Two-thirds of the difference between the book value and fair value of Delta's identifiable net assets at acquisition is attributable to depreciable assets having fair value greater than their book value and the remaining one-third is attributable to land having fair value in excess of its book value. The depreciable assets have an average remaining useful life of 10 years and are being depreciated by the straight-line method with zero residual value.

Required: 1. Provide the journal entries that Newyork Capital would make in 2014 and 2015 to account for its investment in Delta Crating under the equity method. Provide supporting details for all calculations needed.

2. Determine the carrying value of Newyork's Investment in Delta Crating account on December 31, 2014, and December 31, 2015, under the equity method.

3. Now assume that Newyork elected the fair value option for the equity method on the January 1, 2014, acquisition date. Repeat requirements 1 and 2.

4. Based on your answers, discuss the impact of the fair value option on Newyork's net profit margin in 2014 and 2015.

|

Describe the components of the action research process

: Describe the components of the action research process. Describe the components of evaluation research process. Include a discussion of formative evaluation.

|

|

How much would hollern report for cost of goods manufactured

: If beginning finished goods inventory was $5,000 and cost of goods sold was $20,000, how much would Hollern report for cost of goods manufactured

|

|

Prepare an incremental analysis schedule to demonstrate

: Prepare an incremental analysis schedule to demonstrate what amount operating income would increase or decrease as a result of accepting the special order

|

|

Differences in healthcare and health care occupations

: Explain the idea that health care is a gendered institution. How does this relate to differences in health, patient care, and health care occupations?

|

|

Determine the carrying value of newyork investment

: Determine the carrying value of Newyork's Investment in Delta Crating account on December 31, 2014, and December 31, 2015, under the equity method.

|

|

Determine ruby nol for the year

: Ruby Corporation, a calendar year taxpayer, has the following transactions:Income from operations $ 300,000. Determine Ruby's NOL for the year

|

|

What role does the internal revenue service play

: What role does the Internal Revenue Service play in interpreting, and providing guidance on, the tax law? What types of tax law guidance are published by IRS

|

|

Company would like to evaluate two incentive schemes

: A company would like to evaluate two incentive schemes that take effect once the worker exceeds standard performance.

|

|

Discuss what is the break-even point in sales dollars

: What is the break-even point in sales dollars and in units if the fixed factory overhead increased by $1,700

|