Reference no: EM131044968

Financial Accounting-

Question 1 - Accounting policies, changes in accounting estimates and errors

Blake Ltd is finalising its financial statements for the reporting period ending 30 June 2015. A number of unrelated scenarios still need to be considered and accounted for before the financial statements are finalised:

a) The company has, in the past, always recognised a provision for warranties equal to 5% of sales made during the year. Due to increasing warranty costs and the number of goods returned under warranty, the directors would like to increase the provision to 8% of sales made during the year. The provision for warranties account currently has a balance of $12,000, which is the balance carried forward from 30 June 2014. Sales for the year ended 30 June 2015 amounted to $460,000.

b) During the verification process for accounts payable, it was discovered that an amount of $80,000, incurred in May 2015 and payable to a supplier for raw materials, was recorded in the accounting records as $8,000. The $80,000 owing at 30 June 2015 was paid in July 2015.

c) During the verification process for office equipment, it became apparent that an item of office equipment that was thought to be on hand at 30 June 2014 had actually been destroyed in April 2014. The item had a cost of $40,000 and accumulated depreciation of $24,000. No depreciation has been calculated or recorded as yet for the year ended 30 June 2015.

d) During the verification process for accounts receivable, it was discovered that the sales manager had undertaken fraudulent activity - raising fake sales invoices in June 2015. The motivation of the manager was to ensure that his sales targets were met, so that he was eligible for his performance bonus. The fake sales invoices amounted to $122,000, with this entire amount included in the accounts receivable balance at 30 June 2015.

e) On 1 July 2014, the directors revised the useful life of its building (acquired 2 years earlier on 1 July 2012 for $600,000, with an estimated useful life of 20 years and residual value of nil on this date). On 1 July 2014, the remaining useful life was estimated to be 30 years. The building has been depreciated using the straight-line method over its useful life. No depreciation has been calculated or recorded as yet for the year ended 30 June 2015.

Assume all amounts are material for financial statement purposes.

Required: With reference to AASB 108, explain whether each of the above scenarios is a change in accounting estimate or an error. State the appropriate accounting treatment (including any journal entries needed) for each scenario in the 2015 financial statements.

Question- 2 Accounting for income tax

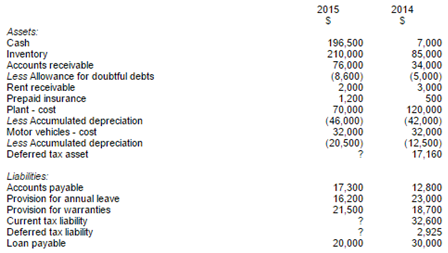

Frog Ltd has prepared its draft statement of profit or loss and other comprehensive income and statement of financial position on 30 June 2015. The statements are prepared before considering taxation. The following information is available:

Extract from statement of profit or loss and other comprehensive income for the year ended 30 June 2015.

Assets and liabilities as disclosed in the Statement of Financial Position as at 30 June 2015.

Assets and liabilities as discloses in the Statement of Financial Position as at 30 June 2015.

Additional information:

- All administration, rent and salaries expenses incurred have been paid as at year end.

- Tax deductions for annual leave, warranties, insurance and rent are available when the amounts are paid, and not as amounts are accrued.

-Amounts received from sales, including those on credit terms, are taxed at the time the sale is made.

- Rent income is taxed when amounts are received, and not as amounts are accrued.

- The company can claim a tax deduction of $10,500 for depreciation on plant, and $12,000 for depreciation on motor vehicles. Accumulated depreciation for tax purpose at 30 June 2014 was $31,500 for plant, and $18,750 for motor vehicles.

- The plant sold during the year (sold on 1 July 2014) had been purchased for $50,000 on 1 July 2013. For taxation purpose, the plant was depreciated at 15% p.a.

-The tax rate is 30%.

Required:

1. Determine the balance of any current and deferred tax assets and liabilities as at 30 June 2015, in accordance with AASB 112.

2. Prepare the journal entries to record the current tax liability and movement in the deferred tax assets and deferred tax liabilities.

Question- 3 Impairment of assets

Jack Ltd has a division that represented a separate cash generating unit. At 30 June 2015, the carrying amounts of the assets of the division, valued pursuant to the cost model, are as follows:

| Assets: |

$ |

| Cash |

42,000 |

| Palnt and equipment |

600,000 |

| Less: accumulated depreciation |

(120,000) |

| Land |

800,000 |

| inventory |

90,000 |

| Accounts receivable |

27,000 |

| Patent |

150,000 |

| Goodwill |

10,000 |

| Carrying amounts of cash generating unit |

1,599,000 |

The receivables were regarded as collectable, and the inventory's fair value less costs to sell was equal to its carrying amount. The patent has a fair value less costs to sell of $140,000, and the land has a fair value less costs to sell of $825,000.

The directors of Jack estimate that, at 30 June 2015, the fair value less costs to sell of the division amounts to $1,500,000, while the value in use of the division is $1,560,000.

As a result, management increased the depreciation of the plant and equipment from $40,000 p.a. to $45,000 for the year ended 30 June 2016.

By 30 June 2016, the recoverable amount of the cash generating unit was calculated to be $55,000 greater than the carrying amount of the assets of the unit.

Required:

Determine how Jack Ltd should account for the results of the impairment test at 30 June 2015 and 30 June 2016, and prepare any necessary journal entries. Show all workings and provide references to the relevant accounting standard to support your answer.