Reference no: EM132984269

Question: Sydney Kitchens Pty Ltd builds and installs kitchens offering credit facilities to its customers. The accounting records at 30 June 2020 reveal the following. All amounts shown {except where indicate? include GST.

Credit sales {for year] $861,300

Credit sales returns and allowances (for year] 67 100

Accounts receivable (balance 30 June 2020) 284 438

Allowance for doubtful debts (credit balance 30 June 6 465

2020, excluding GST)

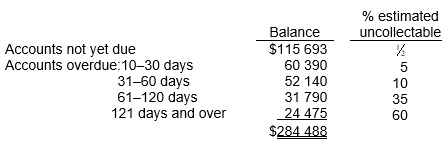

In the past, the company's vearty bad debts expense had been estimated at 2.5 % net credit sales revenue. It was decided to compare the current method with an ageing ofthe accounts receivable method. The following analysis was obtained with respect to the accounts receivable:

Required

A Prepare the journal entries to adjust the Allowance for doubtful debts at 30 June 2020 unden

1. the net credit sales method

2. the ageing of accounts receivable method.

B. Determine the balance in the Allowance for doubtful debts account under both methods