Reference no: EM131959224

Questions -

Question 1 - Determine the asset turnover ratio and total debt to total assets ratio for the Littleton Gift Shop & Tackle Store. The store has average total assets of $135,400. It has current liabilities of $11,200 and long-term liabilities of $43,400. Net sales in the past month totaled $23,040. The gift shop currently has $6,500 in cash and inventory worth $62,300. The store's total assets at present are $136,800.

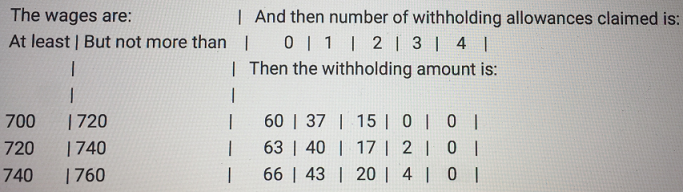

Question 2 - Kathy is single and is paid semi-monthly. She can claim 1 withholding allowance. Her latest paycheck shows gross earnings of $735.15. Using the tax table below, find her federal tax withholding. If she also owes $56.24 in Medicare and Social Security deductions, find her net pay.

Question 3 - Prepare a vertical analysis of the income statement below.

FauxCompany LLC. Income Statement Revenue:

|

Gross sales

|

$650,000

|

|

Less: returns and allowances

|

$10,800

|

|

Net sales

|

$639,300

|

|

Cost of goods sold:

|

|

|

Cost of beginning inventory

|

$150,200

|

|

Add: purchases

|

$235,900

|

|

|

$386,000

|

|

Less: ending inventory

|

$134,000

|

|

Cost of goods sold

|

$252,100

|

|

Gross profit (loss)

|

$387,200

|

|

Expenses:

|

|

|

Salary

|

$140,000

|

|

Rent/Utilities

|

$45,000

|

|

Maintenance/Upkeep

|

$11,200

|

|

Depreciation

|

$4,300

|

|

Total expenses

|

$200,700

|

|

Net income (loss)

|

$186,500

|

Question 4 - If the base is 680 and the rate is 18%, what is the portion?

Question 5 - Maria's Grocery orders some refrigeration equipment. The invoice arrives May 10, with terms 2/10 EOM. They cannot pay the bill in full by June 10, but they pay $675 on June 8. If the total amount of the invoice was $915, what was the amount credited for their first payment, and what is the outstanding balance after June 8?

Question 6 - Keisha has been watching a leather coat at the mall. Yesterday, the coat was reduced 30%. The original price was $379.95. How much is the sale price of the leather coat?

a. $264.96

b. $165.96

c. $275.96

d. $255.96

e. None of the above

Question 7 - A retailer can purchase a guitar from the manufacturer for 45% off of the list price. If the list price is $2,499, what is the trade discount? What is the net price?

Question 8 - Find the mean of the following data: 102, 81, 95, 287, 19, 6, 112, 77.

Question 9 - A table lamp is sold $107, and cost the retailer $85 to purchase it from their distributor. What is the percent markup based on cost?

Question 10 - Jania makes $2,130 in January of this year. If her employer is entitled to the maximum FUTA credit, what SUTA and FUTA taxes does her employer owe on these wages if the SUTA tax rate is 5.4%? If all the employees wages were excluded from the state unemployment tax, what FUTA tax would her employer owe?

Question 11 - Whole Harvest Grocers specializes in local organic produce. They purchase 120 pounds of green bell peppers from a local farm at $1.05 per pound. Whole Harvest Grocers knows that about 9% of the peppers will have to be discarded. Given this, what price per pound must they set on the peppers to achieve a 210% markup based on cost?

Question 12 - Yolanda earns a monthly salary of $5,000, and is nonexempt from FLSA. Last week she worked a total of 51 hours to meet a project deadline. What does she make in overtime per hour? What was her overtime pay for last week?

Question 13 - Prepare a vertical analysis of the following balance sheet.

|

Assets

|

|

|

Current assets

|

|

|

Cash

|

$11,000

|

|

Accounts receivable

|

$9,500

|

|

Inventory

|

$3,200

|

|

Total current assets

|

$23,700

|

|

Plant and equipment

|

|

|

Equipment

|

$26,600

|

|

Total plant and equipment

|

$26,600

|

|

Total assets

|

$50,300

|

|

Liabilities

|

|

|

Current liabilities

|

|

|

Accounts payable

|

$9,500

|

|

Wages payable

|

$8,200

|

|

Total current liabilities

|

$17,700

|

|

Long-term liabilities

|

|

|

Mortgage payable and loans

|

$32,000

|

|

Total long-term liabilities

|

$32,000

|

|

Total liabilities

|

$49,700

|

|

Owner's Equity

|

|

|

Capital

|

$600

|

|

Total liabilities and equity

|

$50,300

|

Question 14 - An item is sold for a 24% markup based on selling price. The markup for the item is $30.00. Find the cost and selling price for the item.

Question 15 - A product with a list price of $14,680.00 and a trade discount series of 10/30/20 has a net price of:

a. $7,648.22

b. $6,748.06

c. $7,398.72

d. $4,680.00

e. None of the above

Question 16 - Create a line graph to display the following data. Make sure to label the plot and label all axes.

Total Sales by Month

|

Month

|

Total Sales

|

|

Jan

|

$18,900

|

|

Feb

|

$22,200

|

|

Mar

|

$16,500

|

|

Apr

|

$17,400

|

|

May

|

$19,200

|

|

Jun

|

$21,700

|

Question 17 - The cost of a particular machine part used to be $450. Now, the part costs $535. What is was the percent change in the cost of the part?

Question 18 - Wilson's Produce pays $0.12 per pound for corn on the cob. If Wilson's buys 600 pounds of corn on the cob and anticipates a spoilage factor of 20%, what will be the selling price per pound such that he makes a 195% markup based on cost?

a. 12.0 cents per pound

b. 25.4 cents per pound

c. 44.3 cents per pound

d. 23.4 cents per pound

e. None of the above

Question 19 - Find the range of the following data: $18.20, $16.90, $46.40, $22.76, $19.10, $7.74, $35.61, $72.76, $20.16, $13.49.

Question 20 - A motor vehicle costs $36,500, with an additional $750 delivery charge, and has an expected useful life of 175,000 miles, with a salvage value of $2,000. Calculate the unit depreciation for 1 mile using the units-of-production method. Calculate the book value of the car after it has done 110,000 miles.

Question 21 - If an asset has an estimated useful life of 4 years, the rate of depreciation using twice the straight-line rate is:

a. 25%

b. 50%

c. 75%

d. 100%

e. None of the above

Question 22 - A set of equipment in a bakery cost $25,000 when new, and has an expected lifespan of 6 years. Its resale value will be $2,500. What is the accumulated depreciation for the first two years using a double declining-balance method?

Question 23 - MacNally Orchards purchases section 179 eligible equipment and places it into service at midyear. The total cost of the equipment is $189,540, and the maximum section 179 deduction of $125,000 is elected. Find the first and second year depreciation using MACRS rates 14.29% and 24.49% respectively. What is the book value at the end of the second year?

Question 24 - Nathan is purchasing a desktop workstation to do modeling and simulations. He has specified a computer with a list price of $8650, and is being offered either a 10/5/5 trade discount series, or a 5/8/8 trade discount series. Which is the better deal? What trade discount does he receive using this series?