Reference no: EM131624607

Question: Wally Wonders Whether There's a Place for Dividends

Wally Wilson is a commercial artist who makes a good living by doing freelance work-mostly layouts and illustrations-for local ad agencies and major institutional clients (such as large department stores). Wally has been investing in the stock market for some time, buying mostly high-quality growth stocks as a way to achieve long-term growth and capital appreciation. He feels that with the limited time he has to devote to his security holdings, high-quality issues are his best bet. He has become a bit perplexed lately with the market, disturbed that some of his growth stocks aren't doing even as well as many good-grade income shares. He therefore decides to have a chat with his broker, Al Fried.

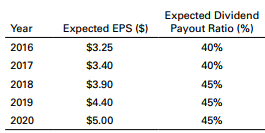

During their conversation, it becomes clear that both Al and Wally are thinking along the same lines. Al points out that dividend yields on income shares are indeed way up and that, because of the state of the economy, the outlook for growth stocks is not particularly bright. He suggests that Wally seriously consider putting some of his money into income shares to capture the high dividend yields that are available. After all, as Al says, "the bottom line is not so much where the payoff comes from as how much it amounts to!" They then talk about a high-yield public utility stock, Hydro-Electric Light and Power. Al digs up some forecast information about Hydro-Electric and presents it to Wally for his consideration:

The stock currently trades at $60 per share. Al thinks that within five years it should be trading at $75 to $80 a share. Wally realizes that to buy the Hydro-Electric stock, he will have to sell his holdings of CapCo Industries-a highly regarded growth stock that Wally is disenchanted with because of recent substandard performance.

a. How would you describe Wally's present investment program? How do you think it fits him and his investment objectives?

b. Consider the Hydro-Electric stock.

1. Determine the amount of annual dividends Hydro-Electric can be expected to pay over the years 2016 to 2020.

2. Compute the total dollar return that Wally will make from Hydro-Electric if he invests $6,000 in the stock and all the dividend and price expectations are realized.

3. If Wally participates in the company's dividend reinvestment plan, how many shares of stock will he have by the end of 2020? What will they be worth if the stock trades at $80 on December 31, 2020? Assume that the stock can be purchased through the dividend reinvestment plan at a net price of $50 a share in 2016, $55 in 2017, $60 in 2018, $65 in 2019, and $70 in 2020. Use fractional shares, to 2 decimals, in your computations. Also, assume that, as in part b, Wally starts with 100 shares of stock and all dividend expectations are realized.

c. Would Wally be going to a different investment strategy if he decided to buy shares in Hydro Electric? If the switch is made, how would you describe his new investment program? What do you think of this new approach? Is it likely to lead to more trading on Wally's behalf? If so, can you reconcile that with the limited amount of time he has to devote to his portfolio?