Reference no: EM131573211

Assignment

1)

a) Describe in one or two sentences what the Fed funds rate is.

b) Suppose that, some years from now, the Fed funds rate is 4% and that you are considering buying a car. You also intend to finance the purchase with a loan. Suppose that the Fed increases the Fed funds rate to 4.5%. Financially, is this good news for you or not? Explain why.

2) Suppose that the Fed purchases from bank B some bonds in the open market and that, before the sale of bonds, bank B had no excess reserves.

a) Describe what initially happens to the reserves of bank B.

b) If bank B does not want to hold excess reserves, what will it do with the money received from the sale of bonds to the Fed?

c) Why do we expect, at least in usual times, that the amount of checking deposits in the economy will go up? Describe briefly the various "rounds" of this process.

d) Now suppose that minimum required reserve ratio for banks is 1/10. Also suppose that banks hold no excess reserves and that currency in circulation is unchanged from the purchase of bonds. If the Fed buys $20 billions of bonds from bank B, what will be the exact change in checking deposits, loans and reserves?

3)

a) Suppose that AD is weak because of low consumers and business optimism. For this reason, unemployment is above NAIRU. Represents this situation using an AS/AD graph (do not forget to distinguish between SRAS and LRAS).

b) The Fed is concerned about high unemployment. What do you expect the Fed will do, sell Treasury bonds or buy Treasury bonds? How is this type of monetary policy called?

c) Represent on a graph the effect of the Fed's policy on the Fed funds rate. The graph should have the Fed funds rate on the vertical axis and it should clearly distinguish the old and the new equilbrium value of the Fed funds rate.

d) Which components of AD does the Fed try to affect and how? If the policy work as intended, show its effects on the AS/AD graph you drew for question a).

4) Suppose that on July 1, 2016 a U.S. pension fund invested $100 millions in 1-year Certificate of Deposits (CDs) from country B. These CDs are denominated in BPounds. Suppose also that these CDs offered a nominal (in terms of B-pounds) interest rate of 5%. Suppose also that the exchange rate at that time was $2.32 per B-pound.

a) The exchange rate a year later, on July 1, 2017, was $2.57 per B-pound. What rate of return, in terms of nominal dollars, did the fund earn on its investment? (Note: a specific numeric answer is required. Please show the steps of your calculations.)

b) What would have been the return on the investment if the exchange rate on July 1, 2017 had been $2.20 per B-pound? Which exchange rate does the U.S. pension fund manager prefer? Explain your answer.

5)

a) Draw a supply-demand diagram of the foreign exchange market for the dollar (valued in "euros") and don't forget to label the axes. In this market, who demands dollars? Who supplies dollars?

b) If, in more usual economic times (rather than a deep recession), the Fed were to announce an increase in the Fed funds rate, what would you expect to happen to the value of the dollar? Show your answer on the graph and briefly explain it.

6)

a) When the last recession hit, Congress agreed to increase government spending. Briefly defend this choice referring to the Keynesian view of fiscal policy. (Note: mention "aggregate demand" and "multiplier" in your answer).

b) Briefly explain the limitations of fiscal policy according to the "Crowding out" view of fiscal policy

c) We have usually discussed the effects of fiscal policy on aggregate demand. But can fiscal policy also affect the long-run aggregate supply, e.g. by shifting it to the right (i.e. increasing growth) or to the left (i.e. lowering growth)?

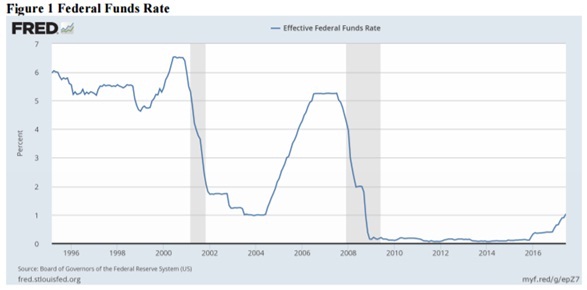

7) Figure 1 below graphs the federal funds rate since 1995 (the graph is also visible here: https://fred.stlouisfed.org/series/FEDFUNDS). The shaded regions correspond to U.S. recessions.

a) Given what you have learnt about the actions and motivations of the Fed, explain why the Fed decreased the federal funds rate during the last two recessions.

b) As you can see from the graph, the Fed raised the federal funds rate in 2004 up to 2006. Again, explain what might have motivated the Fed to act in such a way

c) As you can also see from the graph, the federal funds rate has been virtually zero since 2009 to 2016. The Fed would have liked to decrease the rate further but it wasn't able to do so because the rate cannot become negative. In this situation, the Fed had to resort to other tools to implement its monetary policy objectives. Briefly mention some of these tools.