Reference no: EM131983513

Assessment-01

Question 1

Explain in 280-300 words the key purpose and objective of budgets and forecasts, including relevance of milestones and key performance indicators

Question 2

You have been asked to prepare the annual budget for a small business. The CEO has been helpful and shown you around. They have been responsible for the previous period's budgets. You have been introduced to the three departmental managers of marketing, production and logistics. The marketing manager has given you a sales forecast that they are confident with.

a. Describe who else you will talk to in order to set the sales assumption forecast. How will you document this? How is the sales budget used to build the other budgets? (100-120 words)

b. What five steps does Shim propose for building the master budget?

c. Who is responsible and what standards for negotiations should be set during budget meetings with the managers and CEO? (120-150 words)

d. In what circumstances do NFPs compete for funding and what can influence the outcome of funding applications? (50-80 words)

Question 3

Identify and describe four types and sources of data and information required for budgeting and forecasting. Explain in 150-160 words how data is applied to budgeting and forecasting processes.

Question 4

Explain in 180-220 words what is meant by expenditure and revenue and identify five items relevant to budgeting and forecasting activities.

Question 5

How does:

a. Revenue forecasting affect the rest of the budget process? (100 words).

b. What are the limitations of revenue forecasting technique? (20-60 words).

c. How can this be countered? (20-60 words).

d. There are several managers-including sales, production and transport-in the company where you work who each understand the company's budget objectives. As the head accountant you have been given last year's master budget and told to use all sources of information in assembling objectives and assumptions for the next year's expense budgets. (100-120 words)

Question 6

The amount of raw materials to be purchased is finalised including an accurate assumption from the production manager. Where else would you search for source documentation and what steps does it require to assemble a report about the behaviour of the budget especially the expected cost of raw materials? (80-100 words)

Question 7

Answer the following:

a. Explain in 120-150 words the differences between cash, revenue and expenditure. Provide an example of each category and which budget/s it is relevant to preparing.

b. You have discovered that controls implemented on the printing, postage and stationery account have made significant changes. Each month the savings made are $300. Use the first two columns to complete the worksheet.

|

Voyager Co.

Budget variance worksheet

31.3.2017

|

|

Month

|

Existing Estimate

|

Change to

|

Effect on:

|

|

Income

|

Expenses

|

Cash Flow

|

|

July

|

700

|

|

|

|

|

|

Aug

|

750

|

|

|

|

|

|

Sept

|

800

|

|

|

|

|

|

Oct

|

900

|

|

|

|

|

|

Nov

|

950

|

|

|

|

|

|

Dec

|

800

|

|

|

|

|

|

Jan

|

800

|

|

|

|

|

|

Feb

|

800

|

|

|

|

|

|

Mar

|

800

|

|

|

|

|

|

Apr

|

800

|

|

|

|

|

|

May

|

800

|

|

|

|

|

|

June

|

800

|

|

|

|

|

|

Total

|

9,700

|

|

|

|

|

c. What is the total effect on cash flow? (20-50 words)

d. What effect will the control have on the sales budget? (20-50 words)

e. What effect will the control have on the financial position? (20-50 words)

Question 8

The CEO is trying to manage the level of motor vehicle costs which are putting pressure on the business. You have completed next year's master budget including motor vehicle expenses.

a. What management controls would you suggest in your notes accompanying the master budget for approval? (100-120 words)

b. The CEO has asked for your input into establishing budget timelines. Briefly explain how you can use the concept of a budget calendar in describing reporting timelines to reply to the CEO. (150-200 words)

Question 9

What category of budgets are the governance board more likely to be interested in?

The two categories of budgets are operating and financial. The board is more likely to be interested in the financial budgets.

a. With a long-term view, which specific two budgets are the most relevant to the governing board and for what reason? (50-80 words)

b. A new governance board member is constantly asking the accountant questions about the motor vehicle expenses that are constantly over budget. They blame one of the business managers who they dislike and point to the fact that the manager has an unnecessary sports pack on their car. What type of budget does the motor vehicle expense belong to? Who is responsible for this budget? What steps would you take if you were the accountant? (50-80 words)

c. What does the budget audit examine? (50-80 words)

d. What does the budget audit detect and how frequently should it occur? (50-80 words)

e. What corrective action does the budget audit consider? (140-160 words)

Question 10

Which budgeted statement is the bank account reconciled to? What does reconciling the bank account reveal in regard to the cash flow budget? (50-80 words)

a. Build the projected revenue budget for the six months ending in December.

|

Apollo cash receipts

1.5.20XX-30.9.20XX

|

|

May

|

June

|

July

|

August

|

Sept.

|

Oct.

|

Nov.

|

Dec.

|

|

3,000

|

5,000

|

7,000

|

5,000

|

5,000

|

4,500

|

3,000

|

3,000

|

Note:

Cash receipts are shown. Credit revenues are twice that of cash each month. Credit sales were 3,000 in March and 5,000 in April. Credit terms are 50% by end of the month; 35% by end of the next month balance by end of third month.

b. How is internal competition between projects/ departments competing for funding allocated and what role does the budgeted statement of financial performance play? (80-100 words)

Assessment-02

Part 1

You have been asked by the owner of a new consultancy called Voyager to prepare the master budget. The consultancy consists of the owner who charges out at $68 per hour and the junior staff who are charged out at $42 per hour. The owner has advised you that the following hours are forecast for each quarter.

The consultancy has a credit system of payments with 60% of payment received the quarter in which they are earned and the remaining 40% earned the following month. The opening accounts receivable is $13,200 incl GST. The GST is accounted for on an accrual basis.

1. Prepare a quarterly revenue receipts forecast and cash collections forecast for the next financial year.

|

Hours

|

September

|

December

|

March

|

June

|

|

Senior

|

250

|

230

|

230

|

230

|

|

Junior

|

210

|

220

|

210

|

220

|

|

Voyager Co

Revenue Receipts Forecast

30-June

|

|

|

Hours

|

Receivables

|

|

Quarter

|

Junior

|

Senior

|

Total

|

Junior @ $42/hr

|

Senior @ $68/hr

|

Total

|

GST

|

Total GST inc

|

|

September

|

|

|

|

|

|

|

|

|

|

December

|

|

|

|

|

|

|

|

|

|

March

|

|

|

|

|

|

|

|

|

|

June

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyager Co

Cash Collections Forecast

30-June

|

|

Quarter

|

Receivables

|

September

|

December

|

March

|

June

|

|

|

Opening

|

|

|

|

|

|

|

|

September

|

|

|

|

|

|

|

|

December

|

|

|

|

|

|

|

|

March

|

|

|

|

|

|

|

|

June

|

|

|

|

|

|

|

|

Closing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. The owner will purchase a new vehicle in the September quarter for $27,500. In December they will purchase photocopiers for $5,500 and a computer system for $5,500 with an upgrade in March for a further $2,750. Each item is inclusive of GST. Prepare the Capital Expense Budget for the financial year.

|

Voyager Co.

Capital Expenditure Budget

30 June

|

|

|

September

|

December

|

March

|

June

|

Total GST

|

|

Car

|

|

|

|

|

|

|

Photocopier

|

|

|

|

|

|

|

Computer

|

|

|

|

|

|

|

Total (net GST)

|

|

|

|

|

|

|

GST

|

|

|

|

|

|

3. The information in the table is based on source documentation from the company's previous operations. GST Expenses are shown.

|

|

September

|

December

|

March

|

June

|

|

|

Motor vehicle

|

1,300

|

1,495

|

300

|

450

|

|

|

Printing

|

200

|

50

|

200

|

50

|

|

|

Electricity

|

600

|

555

|

500

|

500

|

|

|

Rent

|

4,500

|

4,500

|

4,500

|

4,500

|

|

Depreciation is $700 per quarter and tax payable at 30% of net profit per quarter. Wages for the senior staff are $8,000 per quarter and junior $5,000.

Complete the expense budget, budgeted statement of financial performance; you will need to add the non GST items to the expense budget, and the cash flow budget which has an opening cash balance of $42,000. The opening GST liability is 2,000 and the opening PAYG tax instalment is 2,500.

|

Voyager Co.

Expense Budget

30 June

|

|

|

September

|

December

|

March

|

June

|

|

Cash Expenses

|

|

|

|

|

|

Motor vehicle

|

|

|

|

|

|

Printing

|

|

|

|

|

|

Electricity

|

|

|

|

|

|

Rent

|

|

|

|

|

|

Sub Total GST inclusive

|

|

|

|

|

|

GST

|

|

|

|

|

|

Net of GST

|

|

|

|

|

|

Wages Senior

|

|

|

|

|

|

Wages Junior

|

|

|

|

|

|

Subtotal Cash Items

|

|

|

|

|

|

Depreciation

|

|

|

|

|

|

Total

|

|

|

|

|

|

Voyager Co.

Budget statement of financial performance

30 June

|

|

|

September

|

December

|

March

|

June

|

Liability

|

|

Service revenue

|

|

|

|

|

|

|

Less Expenses

|

|

|

|

|

|

|

Subtotal

|

|

|

|

|

|

|

Income tax 30%

|

|

|

|

|

|

|

Net Profit

|

|

|

|

|

|

|

Voyager Co

GST Budget

30 June

|

|

|

September

|

December

|

March

|

June

|

Liability

|

|

GST Collected on Sales

|

|

|

|

|

|

|

GST Paid on Expenses

|

|

|

|

|

|

|

GST Paid on Capital Acquisitions

|

|

|

|

|

|

|

Net GST

|

|

|

|

|

|

|

Voyager Co.

Budget statement of cash flows

30 June

|

|

|

September

|

December

|

March

|

June

|

|

Opening Cash

|

|

|

|

|

|

Add Collections from revenues

|

|

|

|

|

|

Total cash available

|

|

|

|

|

|

Less estimated cash payments

|

|

|

|

|

|

Cash Payments in expense budget

|

|

|

|

|

|

Capital Expenditures

|

|

|

|

|

|

GST Payments*

|

|

|

|

|

|

Tax payments

|

|

|

|

|

|

Total

|

|

|

|

|

|

Closing cash balance

|

|

|

|

|

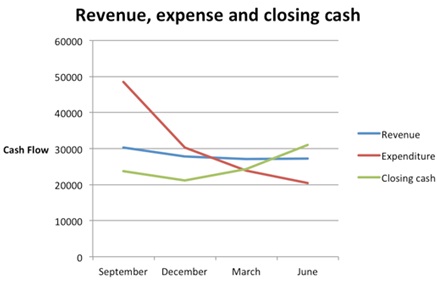

4. Use the cash budget to prepare a graph of quarterly revenue received, payments made and closing cash position.

5. Explain the graph by answering:

a. Which month has the highest payments, what causes this?

b. What advice would you give about the purchase of capital items?

c. Approximately what effect would not be purchasing the capital items have?

d. Which month has the highest revenue received?

e. Describe the position of closing cash throughout the year. The owner realises that there will be significant expenses in this first year of operations. Identify in which quarter the milestone of revenues exceeding expenditures occurs. What effect does this have on cash?

f. What advice would you give about the paying of a $1,000 bonus to the junior staff in June promised in the September quarter based on the staff's performance and the financial performance of the business for the year?(200-220 words)

6. Suppose that Voyager has non-current assets valued at $55,000 with accumulated depreciation at the beginning of the year of 20,000. Use the depreciation expense for the forecast year and other relevant items to complete the budgeted statement of financial position as at 30th June. Assume no depreciation on new non-current assets and all equity is represented by retained profits.

|

Voyager Co.

Budget statement of financial position

As at 30 June

|

|

Cash at bank

|

|

|

|

Accounts Receivable

|

|

|

|

Total Current assets

|

|

|

|

Non-Current

|

|

|

|

Less depreciation

|

|

|

|

Car

|

|

|

|

Computer systems

|

|

|

|

Photocopier

|

|

|

|

Total Assets

|

|

|

|

Liabilities

|

|

|

|

GST

|

|

|

|

TAX

|

|

|

|

Total Liabilities

|

|

|

|

Net assets

|

|

|

|

Owner's Equity

|

|

|

|

Retained Profits

|

|

|

7. What makes setting budget account assumptions time-consuming for Voyager and what must it consider? Discuss in 50-80 words.

Part 2

1. Describe in 150-200 words how budget assumptions operate over time, what makes the best budget assumptions and what happens when they become invalid.

2. Suppose several additional junior staff are employed in subsequent years after a new business is established. The owner notices a large increase in the motor vehicle expense account. What changes to assumptions or controls would you recommend? (80-120 words)

3. Explain in 50-80 words how organisational goals determine the master budget.

4. Briefly describe (30-50 words) what quantitative and qualitative data are in regard to budgeting.

5. What is the budget calendar? (50-80 words)

6. When researching information to complete the cash flow budget, what needs to be considered? (80-100 words)

7. Which management actions can affect the cash flow budget? (80-100 words)

8. How can decision-makers compare projects and what criteria might they use? (80-100 words)

9. What does the budget audit examine? (50-80 words)

10. What does the budget audit detect and how frequently should it occur? (50-80 words)

11. What corrective action does the budget audit consider? (100-130 words)

12. When working to complete budget reporting on time, how should accountants approach new project reporting in a manufacturing business? (80-100 words)

13. How should budget assumptions be dealt with to guard against unethical assumptions? (50-80 words)

14. Who is responsible for budget management? (30-50 words)

15. Who is responsible for oversight of the budget? (30-50 words)

16. In order to be effective, which type of executives should make up the majority of the audit committee members? (30-50 words)