Reference no: EM131488600

Question: This Mini Case is available in MyFinanceLab. Microfinance Company Alfa Cash Capital had financial problems recently. According to independent auditors' report, the main sources of the problems were a shortage of financial analyses and ignorance of capital budgeting issues. To address the issues, the founders of the company created a financial council that will be in charge of the company's financial analyses.

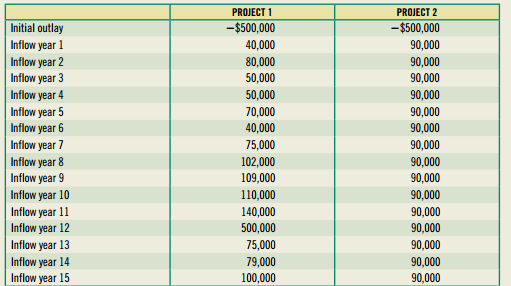

Members of the council are new people with various financial backgrounds, and they decided to make in-depth analyses of every proposed project. Alfa Cash Capital is considering a long-term investment of $500,000 for 15 years. The required rate of return is 15 percent. Since the council thinks that 15 years is quite a long time-period it made the following decision rules for acceptable of investment projects:

(a) NPV should be positive;

(b) pay-back period should be a maximum of 8 years; and

(c) the PI should be close to 5 percent. The company is offered two investment projects for consideration

Task 1: Analyze both investments for all possible criterions, and answer the following questions:

a. Why is the capital-budgeting process so important?

b. Why is it difficult to find exceptionally profitable projects?

c. What is the payback period on each project? Which of these projects should be accepted? d. What are the criticisms of the payback period?

e. Determine the NPV for each of these projects. Should either project be accepted?

f. Describe the logic behind the NPV

g. Determine the PI for each of these projects. Should either project be accepted?

h. Would you expect the NPV and PI methods to give consistent accept/reject decisions? Why or why not?

i. What would happen to the NPV and PI for each project if the required rate of return increased? If the required rate of return decreased?

j. Determine the IRR for each project. Should either project be accepted? k. How does a change in the required rate of return affect the project's internal rate of return? l. What reinvestment rate assumptions are implicitly made by the NPV and IRR methods? Which one is better?

Task 2: The founders of Alfa Cash Capital are not quite happy with this policy, since they think that now the company is too strict with its investments and may lose potential customers. Evaluate the investment police. Explain what factors may ease the processes.