Reference no: EM131113873

The HFS Trustees have solicited input from three consultants concerning the risks and rewards of an allocation to international equities. Two of them strongly favor such action, while the third consultant commented as follows:

"The risk reduction benefits of international investing have been significantly overstated. Recent studies relating to the cross-country correlation structure of equity returns during different market phases cast serious doubt on the ability of international investing to reduce risk, especially in situations when risk reduction is needed the most."

a. Describe the behavior of cross-country equity return correlations to which the consultant is referring. Explain how that behavior may diminish the ability of international investing to reduce risk in the short run. Assume the consultant's assertion is correct.

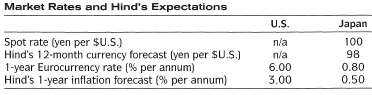

b. Explain why it might still be more efficient on a risk/reward basis to invest internationally rather than only domestically in the long run. The HFS Trustees have decided to invest in non-U.S. equity markets and have hired Jacob Hind, a specialist manager, to implement this decision. He has recommended that an unhedged equities position be taken in Japan, providing the following comment and the table data to support his views:

"Appreciation of a foreign currency increases the returns to a U.S. dollar investor. Since appreciation of the Yen from 100¥/$U.S. to 98¥/$U.S. is expected, the Japanese stock position should not be hedged."

�

Assume that the investment horizon is one year and that there are no costs associated with currency hedging.

c. State and justify whether Hind's recommendation (not to hedge) should be followed.

Show anycalculations.

|

New business proposal to produce a line

: Casey's Cycles manufactures a line of traditional multi-speed road bicycles. Management is considering a new business proposal to produce a line of off-road mountain bikes. The proposal has been studied carefully and the following information is f..

|

|

Determine the primary to secondary ratio of the line

: Determine the primary to secondary ratio of the line-to-line voltages and the line currents.

|

|

Are there any positive consequences of the war on terrorism

: Although terrorism and war typically are viewed only in a negative context, consider and discuss some ways in which these human activities may bring about social change in regions and nations. Are there any positive consequences of the war on terr..

|

|

Rate of return for investment

: What is the rate of return for this investment? (Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places.)

|

|

Describe the behavior of cross country equity

: Describe the behavior of cross-country equity return correlations to which the consultant is referring. Explain how that behavior may diminish the ability of international investing to reduce risk in the short run. Assume the consultant's assertion i..

|

|

To what extent should effectiveness be evaluated

: CASE STUDY 1: Community Perspective on Effective Enforcement Case Study Question: To what extent should effectiveness be evaluated by community residents or other external groups

|

|

Effective treatments for chemical dependency

: How might these methodological considerations affect the research findings and the conclusions drawn from them? How does this article fit in with your paper? How did it influence your own ideas about your paper?

|

|

Assets and net plant and equipment

: The assets of Dallas & associates consist of entirely current assets and net plant and equipment. The firm has total assets of $2.6 million and net plant and equipment equals $2.1 million. It has notes payable of $150,000, long term debt of $746,0..

|

|

Find the maximum kva rating as an autotransformer

: Draw a schematic connection diagram as an autotransformer.

|