Reference no: EM131672710

Question: Multinational transfer pricing, effect of alternative transfer-pricing methods, global income tax minimization. Tech Friendly Computer, Inc., with headquarters in San Francisco, manufactures and sells a desktop computer. Tech Friendly has three divisions, each of which is located in a different country:

a. China division-manufactures memory devices and keyboards

b. South Korea division-assembles desktop computers using locally manufactured parts, along with memory devices and keyboards from the China division

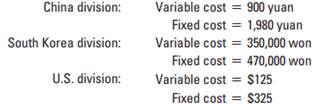

c. U.S. division-packages and distributes desktop computers Each division is run as a profit center. The costs for the work done in each division for a single desktop computer are as follows:

- Chinese income tax rate on the China division's operating income: 40%

- South Korean income tax rate on the South Korea division's operating income: 20%

- U.S. income tax rate on the U.S. division's operating income: 30% Each desktop computer is sold to retail outlets in the United States for $3,800. Assume that the current foreign exchange rates are as follows:

9 yuan = $1 U.S.

1,000 won = $1 U.S.

Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each Tech Friendly desktop computer to a Chinese manufacturer for 4,500 yuan. The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,340,000 won.

1. Calculate the after-tax operating income per unit earned by each division under the following transferpricing methods:

(a) market price,

(b) 200% of full cost, and

(c) 350% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.)

2. Which transfer-pricing method(s) will maximize the after-tax operating income per unit of Tech Friendly Computer?

|

Components of motivation seems to be most problematic

: Suppose you are a management consultant for a large, suburban hospital. Which of three components of motivation seems to be most problematic in this situation.

|

|

Conduct forecast for pricing or the future labor market

: Identify two Web-based tools that you might use to conduct a forecast for pricing or the future labor market.

|

|

Build a turing machine to compute the binary vigenere cypher

: FIT2014- Show that FA-REP is regular by giving a regular expression for it. Does a UFA exist? Give a proof for your answer

|

|

Would a market-based transfer price be agreeable

: Transfer pricing, full cost and market-based transfer prices. Compost Systems, Inc. (CSI) operates a composting service business and produces organic.

|

|

Describe effect of alternative transfer-pricing methods

: Multinational transfer pricing, effect of alternative transfer-pricing methods, global income tax minimization. Tech Friendly Computer, Inc., with headquarters.

|

|

Briefly describe three characteristics for each of colonies

: briefly describe three characteristics for each of the English colonies located in the South, Middle, and New England regions Now state two religious.

|

|

Review the transfer-pricing problem

: Transfer-pricing problem. Refer to Exercise. Assume that division A can sell the 1,900 units to other customers at $137 per unit, with variable marketing cost.

|

|

List five specific groups that were affected by given event

: List five specific groups that were affected by this event. Provide two examples for each cohort describing how they were affected.

|

|

How activist chicanas were treated by chicano men

: How activist Chicanas were treated by Chicano men at Cal State Long Beach UMAS and MEChA to try to undermine their leadership.

|