Reference no: EM131792156

Question: [A] Aon Corporation's Mezzanine Preferred Stock In its 2002 annual report to shareholders, Aon Corporation described its mandatorily redeemable preferred stock as follows: In January 1997, Aon created Aon Capital A, a wholly-owned statutory business trust, for the purpose of issuing mandatorily redeemable preferred capital securities (Capital Securities). The sole asset of Aon Capital A is $726 million aggregate principal amount of Aon's 8.205% Junior Subordinated Deferrable Interest Debentures due January 1, 2027. Aon Capital A issued $800 million of 8.205% (mandatorily redeemable preferred) Capital Securities in January 1997. The Capital Securities are subject to mandatory redemption on January 1, 2027 or are redeemable in whole, but not in part, at the option of Aon upon the occurrence of certain events. During 2002, approximately $98 million of the Capital Securities were repurchased on the open market for $87 million, excluding accrued interest.

Required: 1. Aon's capital securities are forms of preferred stock. Assume that Aon Capital A (the trustee) issued the preferred shares on January 1, 1997, for $800 million cash, the same day that Aon Corporation issued $800 million of its junior debentures to the trust. Describe the cash flows associated with these two transactions-that is, explain who received cash and who gave up cash in each case.

2. One year later (on December 31, 1997), Aon Corporation must pay 8.205% interest to debt holders, and Aon Capital A must pay an 8.205% dividend to preferred stockholders. Describe the cash flows associated with each of these payments-that is, explain who received cash, who gave up cash, and how much cash was exchanged.

3. Why did Aon Corporation create Aon Capital A?

4. For financial reporting purposes, Aon Corporation will issue consolidated financial statements that include the activities of Aon Capital A. In addition, GAAP at the time did not require liability treatment of mandatorily redeemable preferred stock. How did Aon Corporation show its cash interest payment on December 31, 1997?

5. Why does Aon Corporation's 2002 balance sheet show the Capital Securities in the "mezzanine" section between total liabilities and stockholders' equity?

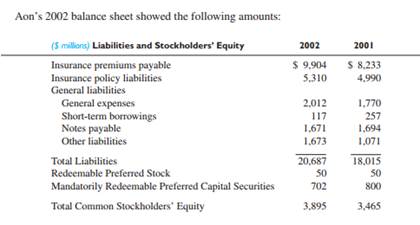

6. Aon Corporation is an insurance company, so most of its liabilities relate to insurance policy premiums and policy liabilities. The company's debt includes Short-term borrowings and Notes payable. Compute Aon's debt-to-equity ratio for 2002 assuming that the Capital Securities are treated as part of equity. Repeat the calculation, this time assuming that the Capital Securities are part of debt. Which debt-to-equity ratio provides the most accurate measure of the company's true debt and equity position? Why?

[B] Cephalon Inc.'s Zero-Coupon, Zero Yield-to-Maturity Convertible Notes Cephalon Inc. issued $750 million of zero-coupon convertible notes. Because the notes were issued at par, meaning that Cephalon received $750 million cash for the notes, they have a zero yield-to-maturity. Settlement in cash upon conversion is not permitted. Here is what Cephalon said about the notes: We issued and sold in a private placement $750.0 million of Zero Coupon Convertible Subordinated Notes (the "Notes"). The interest rate on the Notes is zero and the Notes will not accrete interest. The Notes are subordinate to our existing and future senior indebtedness. The Notes were issued in two tranches and have the following salient terms:

• $375.0 million of Zero Coupon Convertible Subordinated Notes due June 15, 2023 are convertible prior to maturity, subject to certain conditions described below, into shares of our common stock at a conversion price of $59.50 per share (a conversion rate of approximately 16.8067 shares per $1,000 principal amount of notes). The Notes also contain a restricted convertibility feature that does not affect the conversion price of the notes but, instead, places restrictions on a holder's ability to convert their notes into shares of our common stock ("conversion shares"). A holder may convert the notes if one or more of the following conditions is satisfied:

• if, on the trading day prior to the date of surrender, the closing sale price of our common stock is more than 120% of the applicable conversion price per share (the "conversion price premium");

• if we have called the notes for redemption;

• if the average trading prices of the notes for a specified period is less than 100% of the average of the conversion values of the notes during that period;

• if we make certain significant distributions to our holders of common stock or we enter into specified corporate transactions. Because of the inclusion of the restricted convertibility feature of the Notes, our diluted income per common share calculation does not give effect to the dilution from the conversion of the Notes until our share price exceeds the 20% conversion price premium or one of the other conditions above is satisfied. Source: 10-Q filing for Cephalon Inc., June 2003.

Required: 1. Cephalon is a U.S. Company. What accounting entry did Cephalon make to record the $750 million proceeds received from issuing the notes? Over the next year, what other accounting entries (if any) related to these notes did the company make?

2. The notes mature in 2023, approximately 20 years from the date they were issued. At a 6% rate of annual interest, the present value of $1,000 to be received 20 years from today is only $311.805. (You might want to verify this conclusion.) Suppose that Cephalon's true cost of borrowing money is 6% per year. How much did note holders pay for Cephalon debt, and how much did they pay for the option to convert the notes into shares of common stock?

3. Suppose that Cephalon separated the notes into debt and equity components and then recorded each component separately. What accounting entry would the company make on the issue date to record the proceeds received from issuing the notes? Over the next year, what other accounting entries (if any) related to these notes would the company make?

4. Describe Cephalon's financial reporting advantages of issuing zero-coupon, zero yieldto-maturity notes rather than a more traditional debt instrument. Why aren't the notes included in the company's computation of diluted earnings per share?

5. If Cephalon were to issue those same notes today, would it still be able to use the accounting entries outlined in your answer to requirement 1?

[C] Avenet's Cash Settled Convertible Debt Avenet Inc., a U.S. company, is a global provider of electronic parts, enterprise computing and storage products, and supply chain and logistics services for the electronic components industry. The company's 2009 annual report contained the following note: The Financial Accounting Standards Board issued authoritative guidance which requires the issuer of certain convertible debt instruments that may be settled in cash (or other assets) on conversion to separately account for the debt and equity (conversion option) components of the instrument. The standard requires the convertible debt to be recognized at the present value of its cash flows discounted using the non-convertible debt borrowing rate at the date of issuance. The resulting debt discount from this present value calculation is to be recognized as the value of the equity component and recorded to additional paid in capital. The discounted convertible debt is then required to be accreted up to its face value and recorded as non-cash interest expense over the expected life of the convertible debt.

Required: 1. At the time this authoritative guidance was issued, Avenet had already issued $300 million of 2% Convertible Senior Debentures due in 2034. The debentures were issued at par several years earlier, and thus Avenet received the full $300 million cash at the issue date. What journal entry did Avenet make at the time to record the convertible debt issuance? How much interest expense would Avenet record each year?

2. Under the approach now required by GAAP for cash-settled convertible debt, Avenet says the debt discount to be recorded at the issue date would have been $50 million and that the nonconvertible debt borrowing rate at the date of issuance would have been 7%. What journal entry would Avenet make to record the convertible debt issuance under current GAAP? How much interest expense would Avenet record during the first full year?

3. If Avenet followed IFRS guidance rather than U.S. GAAP, which of the two accounting treatments would the company have used at the issue date?

4. Avenet decided to extinguish its 2% Convertible Subordinate Debentures just prior to adopting the new U.S. GAAP guidance (described above) for cash settled convertible debt. Why did the company decide to retire the debt early?