Reference no: EM132323997

Environmental Economics Assignment -

Problem Set - Coase's Theorem and Tradable Permits

1. (Coase's Theorem): In a remote valley, two businesses share a waterway. Tom's Tomato Farm pumps water from a river and uses it to irrigate its fields. The used water eventually flows back into the river, carrying some of the fertilizer that Tom applies to his crops. Up to a point, more fertilizer helps increase Tom's harvest. Downstream, Jay's Riverview Campground offers campsites to interested vacationers. Fertilizer contamination of the river creates algae blooms that adversely affect Jay's business.

The functions describing the profits of each establishment are:

πT(F) = 32 + 12F - 0.25F2

πJ(F) = 220 - 8F

where the subscripts "T" and "J" refer to Tom's and Jay's places of business, respectively. "F" represents the amount of fertilizer in the river generated by Tom.

(a) Derive the functions representing (i) the marginal benefit of fertilizer to Tom and (ii) the marginal cost of fertilizer to Jay. Plot them on the graph on the following page.

(b) Suppose that the existing law defines property rights that favor recreational users of waterways (e.g., campsites) at the expense of farmers. A campsite can sue a polluting farmer for prohibitive damages if any pollution takes place, unless the affected parties consent to an alternative agreement. Indicate (i) the amount of pollution that takes place in this scenario, and (ii) the profits of Tom and Jay. Assume that Jay has all the bargaining power (i.e., he captures the entire Coasian bargaining surplus).

(c) There exists a containment process for recapturing irrigation water in underground troughs and cleansing it of any leached fertilizer contaminants. This technology, which can be purchased for a cost of $X, would prevent Tom's operations from polluting the river at all (regardless of his choice of F). Suppose property rights and bargaining power are defined as in (b). What is the most Tom would be willing to pay to obtain this new process?

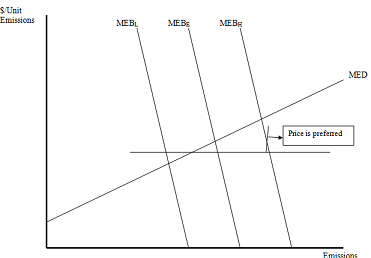

2. (Uncertainty): Consider a market with MED and MEB curves labeled on the axes below where the MEBE curve indicates the expected marginal benefits from emissions and the MEBH and MEBL curves indicate the upper and lower bounds of uncertainty about the emissions benefits.

a. Suppose the government wanted to reach an efficient level of emissions abatement, what would be the best approach, a price-based instrument, or a quantity-based instrument? Explain.

b. If the government went with a quantity-based approach using the MEBE curve and the actual benefits turned out to be MEBH, What would be the deadweight or efficiency loss of such an error? Outline and shade in on the graph above. What about the deadweight loss with a price based approach?

3. (Coase's Theorem): Consider a beekeeper that is deciding how much honey to produce. The beekeeper gains a benefit from producing honey, represented by the marginal benefit function and which is given by: MB = 300 - 6Q

where Q is barrels of honey. In addition, she has a marginal cost function, which reflects her cost of producing honey; this is given by: MC = 40 + 4Q

The more honey the beekeeper produces, the more bees there are to pollenate a neighboring apple orchard. And, thus, in addition to the private benefit accruing to the beekeeper herself, there is also a marginal external benefit to the apple orchard, which is given by: MEB = 100 - 2Q

a. Find an expression for marginal social benefits (MSB) in this case, defined as you think appropriate. Calculate the level of honey production that will arise if the beekeeper acts in her self-interest only. Calculate the socially efficient level of honey production as well.

b. Suppose that the beekeeper and the owner of the apple orchard enter into negotiations. The orchard owner wants to offer a payment to the beekeeper to change honey production from her self-interested production level to the socially efficient level (all at once). What is the maximum total payment that the orchard owner would be willing to pay for this overall change? What is the minimum total payment that the beekeeper would require before making this overall change?

c. Assume that, if a deal is reached, each party must pay $35 in legal fees to finalize it. If there are no additional transaction costs, will the socially efficient quantity be reached? Explain.

d. Irrespective of your answer to the previous part, assume that the beekeeper and the orchard owner come to a private agreement to set honey production at the socially efficient quantity. However, now suppose that a policymaker reads somewhere that honey production provides a positive externality to apple orchards, and therefore decides that the beekeeper should be provided with a production subsidy for each unit of honey that the beekeeper is willing to produce. With this subsidy in place, the beekeeper decides to increase production by an additional 5 barrels. Calculate the associated efficiency loss. If honey is good to eat and bees are good for trees, why is there such a thing as too much honey?

4. (Permit Trading and Initial Allocation Rules): An industry is comprised of two firms, each of whom emit 20 tons of CO2. However, the marginal abatement (or control) costs of the firms differ as described by the following equations:

MAC1 = 4A1

MAC2 = 2.4A2

where MAC is in $/ton and A is in tons CO2 abated/year. The government is considering instituting an allowance (permit) system to achieve an overall abatement goal of 24 tons of CO2 (or equivalently, a reduction in overall emissions of 24 tons). The government is considering grandfathering the permits to the firms (i.e., allocating permits to the firms for free based on their historical emissions) or auctioning the permits to the firms and generating revenue for the government, the latter of which is not politically favored by the industry. Each permit is equivalent to one ton of CO2.

a. Consider the grandfathering option, where trading between firms is not permitted. Based on historical emissions and the desired emissions goal, how many total permits will be allocated by the government? How many permits will be allocated to each firm? How many units of CO2 will each firm abate? What is the cost of achieving these reductions for each firm and for the industry as a whole? Is this economically efficient? Why or why not? (In an example where we're only working with 2 firms, it is sometimes useful to construct consider this graphically)

b. Consider the grandfathering option, where trading between firms is allowed. That is, after the permits are grandfathered to each of the firms, they are allowed to trade them on the CO2 market. What is the price of permits in the market? How many units of CO2 will each firm abate? What will be the abatement costs to each firm? Which firm is selling, which is buying, and how many permits are transferred? After these market transfers are made between the firms, what are the net costs of abatement for each firm and for the industry as a whole? Is this economically efficient? Why or why not?

c. Consider the auction option, where trading between firms is allowed. Suppose that permits are auctioned to the firms by the government. What would be the theoretical market price of these permits at auction? How many permits would each firm buy? What would be the net costs of abatement for each firm and for the industry as a whole? What would be the government revenue generated by the auction? Is this economically efficient? Why or why not?

d. What is the efficiency loss between the grandfathering and auctioning scenarios? (Hint: it may be useful to construct a table illustrating the net costs in parts a - c). How could the government make the auctioning system more politically favorable within the industry? In reality, why might the auctioning system not be as efficient as this theoretical example?

5. (Permit trading): A city is considering introducing a tradable permits program to control local NOx emissions. There are just two types of firms in the city - high (Type II) and low (Type I) cost abaters. There are, however, different numbers of each type of firm. For the sake of simplicity, assume that there are two Type II firms while there is just one Type I firm. A marginal cost of abatement curve for a representative firm of each type is drawn on the diagram on the following page.

Suppose the city freely allocates eI0 and eII0 permits, respectively, to each firm of each type.

(a) On the following graph, show the levels of emissions by each type of firm in equilibrium after trades. Indicate the equilibrium permit price and state the two conditions that must be satisfied in order to be in permit market equilibrium.

(b) What would need to be the case in order for the total number of permits (eI0 + eII0) issued in part (a) is efficient?

(c) What are the net gains from trades (in $'s) in part (a), relative to the situation in which firms face fixed performance standards eI0 and eII0.

(d) What are the social gains from trading if the social marginal costs of NOx emitted by Type I firms (SMCI) is 15, while the social marginal cost of NOx emitted by Type II firms (SMCII) is 30.

(e) Suppose the city instead decides to introduce an emissions tax at the rate τ indicated on the following diagram. Compared with the no-regulation status quo, what cost is imposed on each Type I firm when the tax policy is introduced? What would be the net cost on each Type I firm (relative to no-regulation) under the proposed permits program (note - you need to draw the equilibrium permit price that you calculated in part (a) on this graph)? Which loss is larger?