Reference no: EM137449

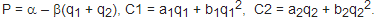

Q. Suppose a monopolist produces a good in two plants, with quantity q1 produced in Plant 1 and q2 produced in Plant 2. The demand and cost functions function of the good is given by:

a) Derive the FOC and SOC conditions of profit maximization for this firm. Show that SOC is satisfied (impose necessary conditions).

b) Suppose that there is a shift in demand (change in α). Show that output will increase in both plants as a result.

c) Which plant will have a greater increase in output? Please explain why.

Q. The demand and cost function of a firm is given respectively by: P = 100 – 4q and C = 50 + 4q. The firm chooses quantity q to maximize revenue subject to the constraint that profit = $334.

a. Find the revenue maximizing q and the price at which the firm would sell this output. Show that SOC is satisfied.

b. Find the output q and price if the firm was a profit maximizing firm.

c. Compare the results in a and b. Please explain the difference.

Q.. Suppose an individual has initial wealth W. There is a chance of losing X with a probability ∏. He can purchase insurance at an actuarily fair premium of ∏y for y dollars of coverage. The individual chooses the amount of coverage to maximize Expected Utility = ∏U(A) + (1-∏)U(B) where:

A= Individual’s wealth if he loses X but collects Y from the insurance company.

B = Individual does not lose X.

Note that in each case the individual has to pay the insurance premium ∏y.

a) Derive the first order condition of utility maximization. Show that if U is concave, the SOC condition of utility maximization will be satisfied.

b) How much insurance will this person buy to protect against the loss of X? Does this depend on risk aversion of the individual? (Hint: what does concavity suggest about risk aversion)

|

Assignment on supply, demand & taxes

: Assignment on Supply, Demand & Taxes, Supply, Demand, and Taxes, The market for tennis shoes exhibits the following supply and demand schedules:

|

|

Calculate the expected return and the expected risk

: The extent of the benefits of portfolio diversification depends on the correlation between returns of securities. Briefly discuss the relationship between the portfolio risk and coefficient of correlation.

|

|

A hierarchical jpeg encode decoder for greyscale images

: This project is to develop a program that implements a hierarchical JPEG encoder/decoder for greyscale images.

|

|

Derive the foc and soc conditions of profit maximization

: Derive the FOC and SOC conditions of profit maximization for this firm. Show that SOC is satisfied (impose necessary conditions). Which plant will have a greater increase in output? Please explain why.

|

|

Java threads

: This is an introductory assignment on Java synchronization. You will use Java Threads while learning more about concurrency and achieving atomicity using Java’s inbuilt mechanisms.

|

|

Capital budgeting case

: Your company is thinking about acquiring another corporation. You have two choices—the cost of each choice is $250,000. You cannot spend more than that, so acquiring both corporations is not an option. The following are your critical data:

|

|

Create and run the following sql queries

: Create and run the following sql queries and submit the screen shot of your result. Also submit the file lab_06_03. sql

|

|

Net-present-value method to analyze investments

: What are the major risk factors that you see in this project? b. As the controller and a management accountant, what is your responsibility to this project? c. What do you recommend the CEO do?

|