Reference no: EM13153539

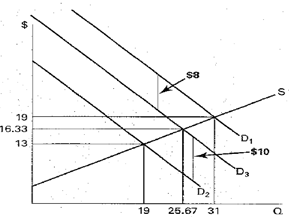

1. For figure demand with zero transactions costs is Q1D = 50 - P and supply is Qs = -7 +2P.

a. Verify all of the prices and quantities calculated in the discussion.

b. Now assume that intermediaries come from competitive market with an equilibrium price of $8 per unit for their services, that is, any buyer or seller who wants an intermediary's services must pay $8 for them. What is the maximum per unit that sellers are willing to pay intermediaries if hiring them saves $8 transaction costs?

c. Does your answer to question 2A change if buyers pay $8 per unit to the intermediary but sellers offer to rebate part of that expense to buyers?

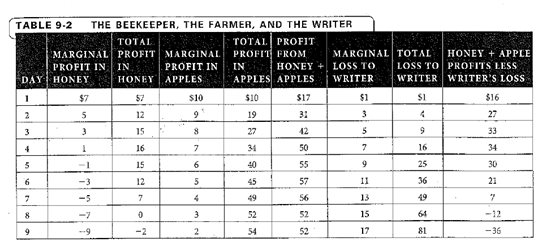

2. What are the highest and lowest payments from the writer that the beekeeper farmer team will accept for the sixth day? Assuming that the farmer can dispose of the $7 from the writer as she wishes, what range of payments will the beekeeper accept? Assuming that the beekeeper gets that amount, what range of payments will the farmer accept? (Remember that negative payments are also possible.) Answer the same questions for the fifth day.

3. Some fields have large enough quantities of both oil and natural gas that coordinator must be achieved for the production of both, rather oil alone as in our examples. Will fields with both oil and gas have greater difficulties in unitization than fields with oil or gas alone? Explain

|

Probability of obtaining four ones in a row when rolling die

: What is the probability of obtaining 4 ones in a row when rolling a fair, six-sided die? Interpret this probability. Suppose that E and F are two events and that P(E and F) = 0.21 and P(E) = 0.4. What is P(FE)?

|

|

Are competitive pressures present in markets

: the incentive of entrepreneurs to develop substitutes for the product supplied by the firms? Are competitive pressures present in markets with high barriers to entry? Discuss

|

|

Difference between liquidation and reorganization

: What is bankruptcy? What is the difference between liquidation and reorganization? What is the main benefit of reorganization. What is a merger? How does a merger differ from other forms of acquisition.

|

|

What role does autophagy play in a cell

: B. Viruses initiate a process that is similar to autophagy. Describe this process and how the virus uses cellular products of autophagy.

|

|

Demand with zero transactions costs

: What is the maximum per unit that sellers are willing to pay intermediaries if hiring them saves $8 transaction costs?

|

|

Should you purchase the insurance product

: Then, in the year after the 10 payments are made, you will receive 10 annual payments of $500 each. Your personal discount rate is 7.5%. Should you purchase the insurance product?

|

|

Effective-interest method to amortize bond premium

: Hrabik Corporation issued $600,000, 9%, 10-year bonds on January 1, 2008, for $562,613.This price resulted in an effective-interest rate of 10% on the bonds. Interest is payable semiannually on July 1 and January 1. Hrabik uses the effective-inter..

|

|

What will happen to the price and quantity

: What will happen to the price and quantity? What will happen to the amount that domestic producers supply? What will happen to revenues of domestic and foreign producers?

|

|

Amount of un-realized intercompany profit

: The inventory cost Yukon $260,000 and was sold to Ontario for $390,000. Ontario still had $60,000 of the goods in its inventory at the end of the year. The amount of unrealized intercompany profit which should be eliminated in the consolidation pr..

|