Reference no: EM131224041

Write the given assignment.

Strategic Asset Allocation (SAA).

For this part, number of words required is about 1000, a word document of IPS, and excel form should be provided.

My group Investment Objectives is Conservative Growth.

Strategic Allocation is based on ETSAC_InvestmentChoiceFlyer.pdf provided by lecturer.

The data has been provided 'AFM -2-2016-assignment data.xlsx'

My lecturer also explain as follows "Please note that I have provided index data in time series over 4 sheets. I have also provided an index for Hedge funds that you can use as a proxy for alternative investments.

Note that some data is in A$ (Australian Bonds and Equities) and the remaining in US$ (International Equities and Hedge funds). Also note that Hedge fund data is provided in returns, while the remaining in prices.

"Assignment Brief:

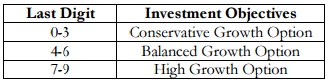

Your 4-member portfolio management team has recently been hired by the Board of Trustees of the Electricity Industry Superannuation Scheme to provide portfolio advice. The current IPS for the 3 schemes is also provided. The investment objectives (based on the last digit of the sum of the team's student numbers) are allocated to each team as follows:

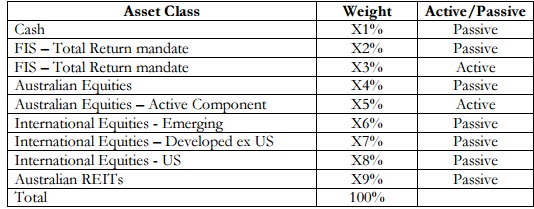

Each team will also design a new asset allocation using the MV framework that fulfils the specified investment objectives. The asset allocation should look as follows:

Team Activities:

A strong team will be one that has a diversified skill set and knowledge base. Desired knowledge and skills include:

(i) Statistical and econometric background including the ability to manipulate data using Excel,

(ii) Understand the long term characteristics of the two core asset classes: Fixed Income Securities and Equities,

(iii) Ability to create and test a Strategic Asset Allocation (SAA),

(iv) Create an active Equity component and

(v) create an active Fixed Income Securities component. The team should also have the ability to write a report that is both academically and professionally complete.

Requirements:

Section 1: Strategic Asset Allocation (SAA). This section will require the team to create a strategic asset allocation for the investment scheme using historic data provided for the 5 asset classes/Sub-asset classes. The international equities will be provided as three benchmarks: Emerging markets, Developed markets ex US and the US market. The portfolio will be created such that (i) an allocation for each asset class is provided and (ii) the proportion between active and passive proportion for the domestic equity component is determined and (ii) the proportion between active and passive proportion for the Fixed Income Securities component is determined.

Attachment:- ETSAC-InvestmentChoiceFlyer.rar

Attachment:- AFM--2-2016-assignment-data.rar

|

Possible values of ebit and associated probabilities

: Equity is worth $51.90 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT an..

|

|

Prepare a presentation about the mortgage market

: Prepare a presentation about The Mortgage Market. Points will be given for asking questions of your fellow classmates to determine their knowledge of the subject.

|

|

How did these twin legacies affect african society

: Assess how the legacy of the slave trade, and intervening imperialist ventures by European nations, has led to the relative underdevelopment of Africa today. How did these twin legacies affect African society, culture, and politics?

|

|

Weight used for equity in the computation of bill wacc

: If the common shares are selling for $30.20 per share, the preferred share are selling for $17.20 per share, and the bonds are selling for 95.98 percent of par, what would be the weight used for equity in the computation of Bill's WACC?

|

|

Create strategic asset allocation for the investment scheme

: Create a strategic asset allocation for the investment scheme using historic data provided for the 5 asset classes/Sub-asset classes.

|

|

Roe for lemmon enterprises

: Lemmon Enterprises has a total asset turnover of 2.4 and a net profit margin of 7.4%. If its equity multiplier is 1.30, what is the ROE for Lemmon Enterprises? (Round answer to 2 decimal places, e.g. 12.25%.)

|

|

Considering opening another officeat a cost

: Opti-Net has a Cost of Goods Sold (COGS) of 57%. They are considering opening another officeat a cost of $22,000 per month. If they have an average revenue of $70 per sale and they only sellone in five customers, what would be the required sales..

|

|

What is the equilibrium price

: Using demand and supply curves, show the effect of each of the following on the market for cigarettes: A cure for lung cancer is found. What is the equilibrium price?

|

|

Describe each of the accounting systems

: Describe each of the accounting systems. Give an example of a company or industry that might use each system and explain why they use it. Format your submission consistent with APA guidelines.

|