Reference no: EM131329726

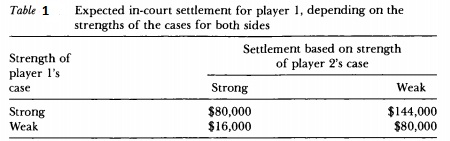

Player 1 is the plaintiff and player 2 is the defendant in a lawsuit for breach of contract. The expected in-court settlement, to be paid by player 2 to player 1 if they go to court, depends on the strength of both sides' cases as shown in Table 6.10. In addition, if they go to court, then each side must pay trial costs of $10,000. So, for example, if both cases are strong and they go to court, then the expected total cost to player 2 is $90,000, but the expected net benefit to player 1 is only $70,000. Each player knows whether his own case is weak or strong, and each side believes that the other side is equally likely to be weak or strong.

Assume that both players are risk neutral. The players could avoid these trial costs by settling out of court. However, in pretrial bargaining, there is nothing to prevent a player from lying about the strength of his case, if he has an incentive to do so. Going to court is the disagreement outcome in any pretrial bargaining.

a. Suppose that you have been asked to mediate the pretrial bargaining between these two players. Create an incentive-compatible mediation plan that has the following properties:

(1) if they settle out of court, then player 2 will pay player 1 an amount equal to the expected incourt settlement, given their reports to you about the strength or weakness of their cases;

(2) if both report to you that they are weak, then they settle out of court with probability 1; and

(3) if one side reports that it is weak and the other reports that it is strong, then they settle out of court with a probability q that does not depend on which side reported weakness. Make q as large as possible without violating any informational incentive constraints.

(HINT: When you compute expected payoffs, do not forget the net payoff from going to court. Player 1 expects to get money from player 2 even if they do not agree to settle out of court!)

b. Imagine that player 1, knowing that his case is actually strong, gets the following advice from his lawyer. "Given that our case is strong, our expected in-court settlement would be 0.5 x 80,000 + 0.5 x 144,000 = $112,000. So let us tell player 2 that our case is strong and offer to settle out of court for this amount."

Show that, even if player 2 were to believe player 1's claim about the strength of l's case, it would be a mistake for player 1 to make an offer to settle for $112,000 when his case is strong.

|

Currency crisis-cause and resolution

: A number of currency crises have affected certain countries, which have also resulted in contagion in the sense that the crises affected neighboring countries.

|

|

After-tax salvage and the return of working capital

: New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,130,000, and it would cost another $22,000 to install it. What is the additional Year-3 cash flow (i.e, the..

|

|

What you want parents and other family members to know

: Write a brief statement that explains what you want parents and other family members to know about why and how children's books are used in your program to promote early literacy.

|

|

Cross-price elasticity for product

: Assume that the price of competing Good B decreases by 5% and as a result, the quantity demand for Good A decreases by 8%. What is the cross-price elasticity for your product? What type of goods are Good A and Good B?

|

|

Create an incentive compatible mediation plan

: Suppose that you have been asked to mediate the pretrial bargaining between these two players. Create an incentive-compatible mediation plan that has the given properties.

|

|

Government budget deficit influence the loanable funds

: How does a government budget deficit influence the loanable funds market and why does a decrease in the deficit lower the real interest rate?

|

|

Current stock price and implied return of stock

: Ramsay Corp. currently has an EPS of $2.30, and the benchmark PE for the company is 22. Earnings are expected to grow at 5 percent per year. What is your estimate of the current stock price? What is the target stock price in one year?

|

|

Identify a library or bookstore in your area

: Identify a library or bookstore in your area with a quality collection of books for children ages 3-5 . You will need to submit your completed version of the Children Literature Selection Chart.

|

|

Monopolist charges price

: The associated marginal cost curve is . In the second market, the monopolist charges price of __________ and sells __________ quantities.

|