Reference no: EM131368393

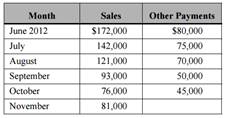

Loblaw Manufacturing has asked you to create a cash budget in order to determine its borrowing needs for the June to October period. You have gathered the following information

April and May sales were $115,000 and $135,000, respectively. The firm collects 35% of its sales during the month, 55% the following month, and 10% two months after the sale. Each month it purchases inventory equal to 60% of the next month's expected sales. The company pays for 40% of its inventory purchases in the same month and 60% in the following month. However, the firm's suppliers give it a 2% discount if it pays during the same month as the purchase. A minimum cash balance of $25,000 must be maintained each month, and the firm pays 6% annually for short-term borrowing from its bank.

a. Create a cash budget for June to October 2012. The cash budget should account for short-term borrowing and payback of outstanding loans as well as the interest expense. The firm ended May with a $30,000 unadjusted cash balance.

b. Bob Loblaw, the president, is considering stretching out its inventory payments. He believes that it may be less expensive to borrow from suppliers than from the bank. He has asked you to use the Scenario Manager to see what the total interest cost for this time period would be if the company paid for 0%, 10%, 30%, or 40% of its inventory purchases in the same month. The balance would be paid in the following month. Create a scenario summary and describe whether the results support Bob's beliefs.

|

Example of poor commenting

: Identify the methods within the example program you believe are not sufficiently documented. Examine the control flow statements to determine what they do and if their purpose is clearly documented.

|

|

Calculate the firm''s expected ending cash balance

: Finally, how would your ending cash balance change if the firm uses any cash in excess of the minimum to pay off its short-term borrowing in each month?

|

|

Analyze the inverted pyramid and its implications

: Write the given essay assignment.- Analyze the inverted pyramid and its implications.

|

|

Demonstrate your knowledge and understanding of materials

: Demonstrate your knowledge and understanding of the materials cited on the Background page. Supplement these with relevant sources you locate on the Web.

|

|

Create a cash budget for june to october 2012

: Create a cash budget for June to October 2012. The cash budget should account for short-term borrowing and payback of outstanding loans as well as the interest expense. The firm ended May with a $30,000 unadjusted cash balance.

|

|

Purpose and value to using arrays and functions

: Describe the purpose and value to using arrays and functions in C++ programming.

|

|

Availability of email and storage servers

: Identify the types of sensitive information contained in email messages and shared storage servers. Then, based on your knowledge of security management, describe techniques designed to protect the confidentiality, integrity, and availability of e..

|

|

Summarize the article given below

: Please summarize the article's.disposable-futures main argument,paying close attention to their interpretation of how historical, economic, and political realities shape artistic representations (150-200 words).

|

|

Different types of storage

: RAM is not the same as ROM and your phone does not use certain types of storage. List at least two (2) different types of storage and how each type is use to support your needs as a user of data.

|