Reference no: EM13953219

Contribution Margin, Cost-Volume-Profit Analysis and Break-even Point

Fixed, Variable and Mixed Costs

An appreciation of cost behavior is needed in order for management to understand and predict profitability as the costs of material, labor and other operating expenses and levels of production and sales change. It's important to review the cost behavior of fixed, variable and mixed costs before contribution margins, cost-volume-profit analysis, and break-even points.

1. In the table below, Have-A-Seat Inc. has outlined many of the costs associated with producing office chairs. With respect to the production and sale of office chairs, classify each cost as fixed, mixed, or variable.

|

a. Pressure-molded plastic for chair frames

|

|

|

|

|

|

|

b. Pension cost: $0.50 per employee hour on the job

|

|

|

|

|

|

|

c. Insurance premiums for inventory: $2,100 per month plus $0.01 for each dollar of inventory over $2 million

|

|

|

|

|

|

|

d. Property taxes: $120,000 per year for the factory building and land

|

|

|

2. Variable costs per unit (INCREASE/DECREASE/STAY THE SAME)with changes in the level of activity, while fixed costs per unit(INCREASE/DECREASE/STAY THE SAME) as the number of units increases and (INCREASE/DECREASE/STAY THE SAME)as the number of units decreases.

Contribution Margin Income Statement

A contribution margin income statement organizes costs by behavior (variable or fixed), rather than by function (operating, selling, or administrative). The contribution margin is the difference between sales and

Byron Manufacturing has one product that sells for $24.00 per unit. The company estimates fixed costs at $6,000, direct materials at $4.00 per unit, direct labor at $5.00 per unit, and variable overhead costs at $3.00 per unit.

Fill in the contribution margin income statement when 730 units are sold:

|

Byron Manufacturing

Contribution Margin Income Statement

|

|

Sales

|

$ ?

|

|

Less: (VARIABLE/FIXED COSTS) ?

|

|

|

|

|

|

Contribution margin

|

$ ?

|

|

Less: (VARIABLE/FIXED COSTS) ?

|

|

|

|

|

|

Operating income

|

mce_markernbsp; ?

|

Calculate Byron Manufacturing's per unit contribution margin : $. ?

The contribution margin ratio is (5/15/35/50)%

.

Calculating the Break-even Point:

The break-even point in sales dollars is $ ?? which is a break-even point in units of ?? units.

CVP Analysis using a chart:

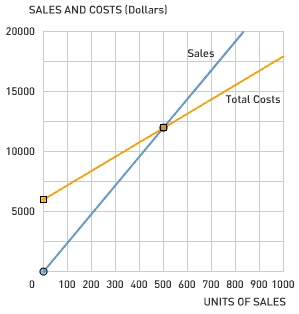

The cost-volume-profit chart for Byron Manufacturing is shown. Use the graph to complete the sentences given below.

Byron Manufacturing reaches its break-even level of activity when it sells ??

units and generates ?? in revenue, because at this level of activity the firm's revenue ?? its total cost. In addition, you can determine from the chart that Byron Manufacturing's fixed costs are ?? and its price per unit is ?? and variable cost per unit is ??

If fixed costs increase, what will happen to the break-even point? (INCREASE/DECREASE)

If the price per unit decreases, what will happen to the break-even point? (INCREASE/DECREASE)

CVP analysis is used to analyze the effects of changes in selling prices, costs and volume on profits. It is also used to determine target profit, the margin of safety, operating leverage, product mix and choosing among marketing strategies and others.

Suppose Byron management has a target operating income of $3,000. Assume the same costs as above and the sell price remains at $24 per unit. How many units does Byron need to sell to meet this goal?

What is Byron's margin of safety in sales and in units when Byron sells 730 units?

Margin of safety in sales $ ?? Margin of safety in units ?? units

What is the degree of operating leverage when 730 units are sold? If required, round your answer to two decimal places??

|

Iphone when the warranty is purchased

: Orange Inc. offers a discount on an extended warranty on its iPhone when the warranty is purchased at the time the iPhone is purchased. The warranty normally has a price of $150, but Orange offers it for $120 when purchased along with an iPhone.

|

|

Calculate and compare the variances and standard deviations

: Two drugs, amantadine (A) and rimantadine (R), are being studied for use in combating the influenza virus. A single 100-mg dose is adminis- tered orally to healthy adults. The response variable is the time (minutes) required to reach maximum conce..

|

|

The birthplace of glenn miller

: Clarinda Community Hospital is a 230-bed, not-for-profit, acute care hospital located in Clarinda, Iowa. The city is a typical Mid-western county seat/farming community best known as the birthplace of Glenn Miller, the famous big band leader of the l..

|

|

How many subjects are in the study

: How many subjects blood pressure increased from the first measurement to the second - determine whether or not subsequent blood pressure measurement where higher or lower than one another.

|

|

Contribution margin cost

: Contribution Margin Cost-Volume-Profit Analysis and Break-even Point

|

|

Analysis of togaf to either dodaf or feaf

: Conduct an in-depth analysis of TOGAF to either DoDAF or FEAF. Referring to assigned readings, and adding the results of your own additional scholarly literature search and analysis, write a 6 to 8 double spaced page paper that addresses the follo..

|

|

Necessary adjusting journal entries

: 1. Record all necessary journal entries relating to these transactions. 2. Assume that Polly's accounting year ends on December 31. Prepare any necessary adjusting journal entries.

|

|

What is the maximum likelihood estimator of theta

: If the prior on theta is uniform such that p(theta)=1, find an expression for the posterior distribution for theta after 10 trials. What is the maximum likelihood estimator of theta?

|

|

The prize money of the canadian open tennis tournament

: n 1970, the prize money of the Canadian Open Tennis tournament was $15,000. In 2012, the prize money was $2,648,700. What was the percentage increase in the prize money over this period? If the winner's prize continues to increase at the same rate, w..

|